Looking at the markets and all the underlying pressures on them, I don’t see how we avoid inflation. I remember feeling a similar feeling in 1992. Bush had messed up the economy by raising taxes and we had a mini-recession. When Clinton was elected I thought there was no way to screw it up. We were going to have a bull market.

I don’t think it matters who is elected President concerning inflation. It doesn’t matter if a million Nobel prize winners say one President’s economic plan will be less inflationary than the others.

Inflation started under Biden and it’s here to stay. Biden and Jimmy Carter are the worst American presidents in my lifetime. Biden is probably worse than Carter all in. He not only was bad economically, morally, and domestically but he also set the world on fire when the right decisions would have kept the potential fire in check. Harris is too dumb to change course.

The real question will be how bad will it be? Harris and the Democrats are touting that inflation is on the way out. It’s not. The reason we have seen inflationary pressure drop is economic activity has dropped. There isn’t a true “soft landing” because everyone is looking at the wrong metrics. Inflation is still with us, and GDP is not exactly blowing the doors off anything. Here is a chart of GDP and you can see clearly when Covid happened.

The Democrats bungled the macroeconomy. Sure, the stock market is higher but Presidents have little or nothing to do with the stock market.

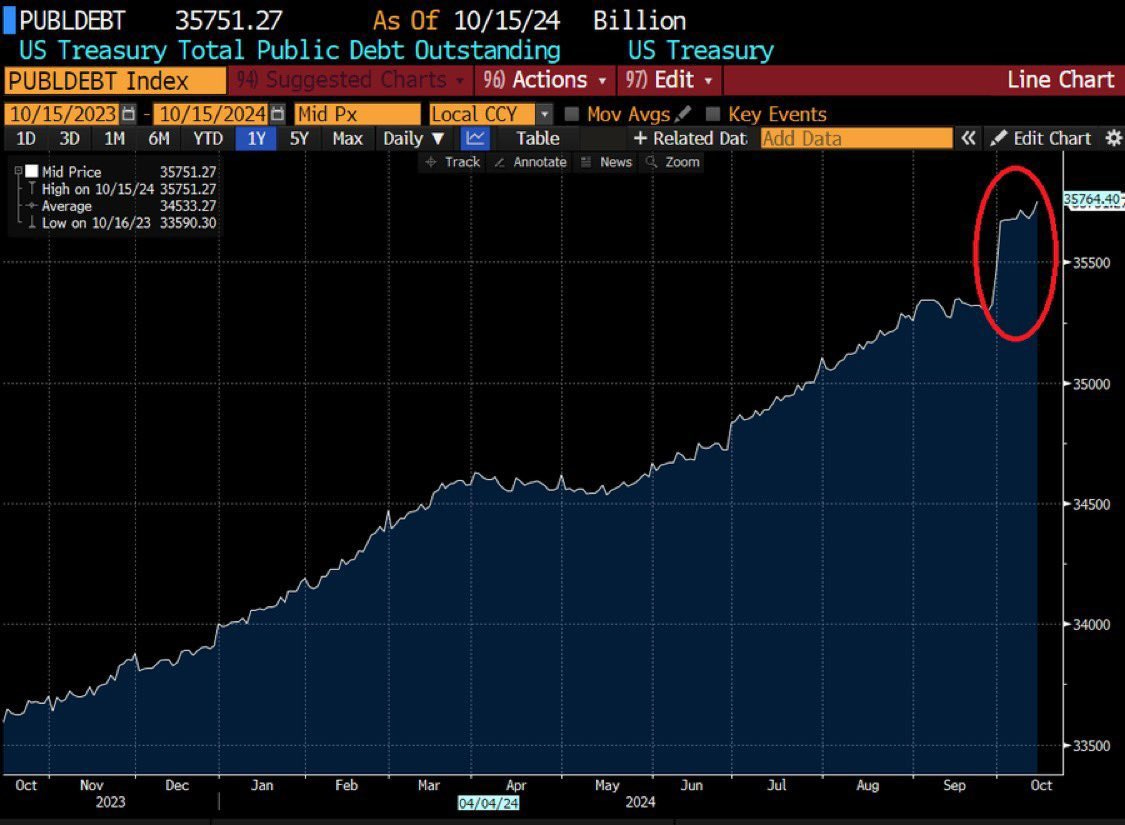

Debt has gone parabolic under the Democrats. It’s not like the Republicans were thrifty or anything but the Dems blew it out.

The US has two choices, inflate or die.

Paul Tudor Jones said he doesn’t see a future without inflation. As a kid who grew up in the 1970s, I experienced it firsthand. I watched my parents deal with it. When Bernanke was Fed President, there was a lot of dialogue about deflation. Yes, deflation is worse than inflation but deflation is also easier to manage. I think the academics and Bernanke were far too worried about deflation which caused a lot of the problems we have today. Quantitative easing for the amount of time that it persisted was not good for the economy.

The Fed was late on the trigger again raising interest rates once inflation came. That caused them to go too fast. The Fed is in a difficult spot because of its dual mandate. They will be forced to raise rates again if inflation kicks up the way I think it can and that’s going to hurt both growth and employment.

There is no way you can “grow” your way out of this deficit. Private economic growth is most certainly the cure but the private economy isn’t a puppet that immediately moves a body part when a string is moved. In addition, even if Elon is superhuman and cuts $2 Trillion out of the government budget, we still will have inflation. That doesn’t take effect immediately. If Trump does a Mileil and is able to cut out a lot of the government spending and regulations that hamper growth, we will still have inflation because it takes time for the underlying microeconomic economy to respond.

Cutting budgets also have opportunity costs. The left-wing media will point to austerity in Europe and how bad it went. The problem is the European economy is so heavily regulated that when they tried austerity there was no raw tinder to build a fire to grow.

One obvious benefit to a Trump Presidency and a Republican-run government is energy policy. The cost of energy winds its way through so many industries when you cut the cost it offers immediate benefits to bottom lines. Not only that, cutting energy costs offers immediate benefits to family budgets.

I think it is true that if you cut government spending and go on a government austerity program where there are fewer transfer payments to individuals and fewer subsidies to companies/individuals, resources open up that the private sector previously couldn’t access. This is a potential benefit to give a good push in growth that is hard to quantify. I don’t think anyone can truly estimate it with any degree of accuracy.

I do think that the progress of artificial intelligence will bring great dividends to economic growth. As we get better and better with it, innovation will be unleashed across the country. AI is still in its early stages but it is finding its way into all kinds of things. Because it is software it can scale quickly and be utilized quickly. That is a bright spot.

Another economic concept that is left unsaid is certain ideas being bandied about will have larger opportunity costs and though they make good political talking points, they aren’t good ideas in practice. Why should we build a plant in the US to manufacture widgets when even after lower taxes and regulation, it’s cheaper to operate that plant outside the US? No doubt, “America first” but what’s the real cost of that, and are we better off using America’s resources to do something else?

Given the tableau, where do you put your money so you don’t get crushed?

Inflationary times are not exactly the best time to try and grow your wealth. Even when your wealth grows, the underlying value of the US dollar is weaker with inflation so you aren’t as “wealthy” as it seems.

Stock and interest rate markets get whacked during inflation. This is why Tudor Jones said he is rotating to commodities.

I think that is the right strategy. There are other ways to play it than just purchasing gold. Look for stocks that give you full exposure to commodities. Mining stocks, farming stocks, agricultural stocks, and energy stocks should at least maintain their relative value if their businesses are well run. Owning the commodity exchanges is also a good way to play it since their volumes should explode. They have a fixed-cost business and more volume equals about 60% or more to their bottom lines.

There are already ETFs you can buy today that will give exposure to each of those sectors without trying to pick individual stocks.

Owning hard assets like a house or some land is a good idea. Real estate doesn’t do “well” in inflationary times but at least it doesn’t become worthless. Real estate also will bounce back when things return to normal. You have to have the cash flow to weather the storm.

The other place to look is private markets. Both private equity and venture capital can give outsize returns that beat inflationary pressure. The problem there is you have to either find a good fund manager to invest in, or find the company yourself. That’s a skill set most people do not have let alone access to the deal flow they need to actually be successful. But, a successful private market portfolio can beat inflation.

The one most people will tout is Bitcoin. I am skeptical about Bitcoin. As I wrote the other day, the blockchain doesn’t scale. Nothing has been built yet on any crypto platform that anyone uses. Currently, all the value in crypto is speculative.

We are in for some tough sledding. Buckle down the hatches.

"Why should we build a plant in the US to manufacture widgets when even after lower taxes and regulation, it’s cheaper to operate that plant outside the US? No doubt, “America first” but what’s the real cost of that, and are we better off using America’s resources to do something else?"

So, I'm fairly free trade, more so than most. But this question does have some answers. I can think of two that are distinct enough to mention separately.

One, and we got a good example during C19, if it's not inside your borders you don't control it. You need a bunch of antibiotics made in India? Well, too bad. India gets to decide that. It doesn't matter as much in "normal" times, but who is to say what is normal? Do we even have a normal these days? Certainly we can't count on things being normal when we are making plans for high inflation since the who point is risk mitigation. Maybe there is some incident with Taiwan and now the US just can't get anything made in China. Who knows.

I was reminded of this semi-recently (2023?) when a stock I owned (SQM) took around a 10% single day hit after Chili nationalized one (or more?) of the lithium mines they "owned". Also pertinent since you specifically mention mining stocks as a possible inflation hedge.

Everyone says it will never happen and then it does. 2023 isn't that long ago.

The second is IP theft. I'm not picking on China specifically but I'll use them as representative. You send a part out to be plastic molded, what exactly is your "value add" once they have the mold and it's running smooth? Maybe they just run some extra parts and put their logo on it? And what are you going to do about it anyway?

I think we take something like "rule of law" for granted and it's not really so. Then people are all "inconceivable!" when it does happen. It's not actually that inconceivable.

Germany recently learned that lesson most painfully with Russian natural gas.

Anyway. Not to detract from your general point, but when building up that cost benefit matrix, lets just make sure we don't completely ignore these very real costs. There are probably others, these are just the ones that came to my mind.

Is anyone aware of any economist's work/papers on what point they think the fiscal debt will reach the point of starting to collapse our economy?

That may seem like an odd question, but I have heard the fiscal alarms for a couple decades now, and we always seem to press on. The last few years it feels like the politicians just gave up and decided to give something away to everyone with total disregard for any budgetary restraint.

I think we are all watching this in a state of numbness, but what do the economists say about when the fireworks are going to get started with a fiscal implosion?