24 Hour Trading

NASDAQ Decides to Add It

When I started on the trading floor in 1986, there were pits, and it was all mano e mano. However, if you looked hard, you saw the future. The CME had a mutual offset contract with the SIMEX, which meant that if you traded on CME and then traded on SIMEX, the two trades were offset. This extended the trading day. However, this was only for financial products like Eurodollars and Forex contracts. Agricultural contracts and the S+P 500 Index weren’t part of the deal.

I used to make markets in Eurodollar spreads overnight sometimes. It was brutal on sleep since the time difference was 13 hours. Sometimes, it gave you a leg up on the rest of the pit, and sometimes, you could cover stuff. One time, in the middle of the night, I woke up from a dead sleep. I said, “I am filled.” A minute later, the phone rang, and they told me I was filled!

The first guy who backed me in trading was Roger Carlsson. He recognized that you could trade Singapore, pass the book to London, then finish in Chicago. He organized credit lines at banks so we could margin in Chicago and London. There was no offset between CME/LIFFE because we competed. There was an active arbitrage market buying one and selling the other, then reversing. It was also possible to arbitrage volatility in options trading.

Funny story. Our trader in London called me up once and said CRT was trading 20% volatility when it was trading 5% lower in Chicago at the same time. Somehow there was a miscommunication. He sold tons and tons of stuff to CRT in London. I started buying it in Chicago, and Roger emerged from the pit and screamed at me. “What are you doing?” I said, “I am selling it at 20% and buying it back for 15%.” I was pretty happy taking 5 points out of a vol trade in seconds. He looked at me and said, “Stop it. I am legging 12%”. We had a good laugh over that one and it lasted a very short time. “The gig is up.”, our trader in London said after about 15 minutes.

One of the most jarring things for me was moving from the Eurodollar pit to the Hog pit in 2003. I was long a 10 lot and didn’t get out on the close. Hogs traded from 9AM to 1PM. When they closed, they closed. No mutual offset. No ringing Singapore in the middle of the night. I had to get out at 9AM the next morning.

When Hogs went 24/7, I didn’t think it was good for the market. It is a highly specialized market. Overnight, there was little volume and it messed everything up. The current hours are a bit different now:

CME Globex:

Monday - Friday: 8:30 a.m. - 1:05 p.m. CT

CME ClearPort:

Sunday 5:00 p.m. - Friday 5:45 p.m. CT with no reporting Monday - Thursday from 5:45 p.m. - 6:00 p.m. CT

There isn’t overnight trading anymore. This seems reasonable. For bona fide hedgers in this market, they have to run businesses outside of their hedge. It lets them worry about that rather than a margin call from some stupid overnight move when no one is awake. It lets liquidity providers get some sleep too.

With stocks, there hasn’t been overnight trading. Futures is trading on the S+P 500 and other indexes 24/7. ETFs trade but they aren’t stocks. There are after hours sessions, but they are expensive and sometimes not efficient to use.

Crypto markets have heavily influenced the move to 24/7. They had no history so they went right to it. Currently, cash crypto markets are not anything but speculative vehicles. Sure, there is some risk management at CME and Bitnomial. But, unlike a traditional futures market, there is not a large, diverse cadre of bona fide hedgers in the market. The only ones I see that should hedge are the miners, or if you are a HODL participant. Mercedes-Benz is hedging their Euro/US Dollar risk but they aren’t hedging their crypto risk. No one is hedging their grain crop or fixing the cost of production inputs via a futures market. Plus, they don’t need to, yet. Maybe someday and since crypto isn’t an equity 24/7 trading fits a lot better.

If public equities get tokenized, it might be better not to trade them 24/7.

This morning, NASDAQ announced they were going 24/7 with public equities. Their CEO just announced it this morning on LinkedIn. Interestingly, he put this in the article:

While trading activities beyond the traditional hours have increased in recent years through off-exchange venues, such as Alternative Trading Systems (ATSs) and broker-dealer platforms, liquidity remains significantly lower during these hours. Therefore, the trading and investing environment during the overnight trading hours include higher volatility and transaction costs

No doubt. Looks like exchange leaders are learning instead of just flipping the switch and going 24/7, throwing caution and market integrity to the wind. They were not like that in the early 2000s. They couldn’t wait to throw the switch.

One reason is the earnings bump received by publicly traded exchanges. Trading 24/7 allows them to spread revenue over their fixed costs for a longer period of time. It also increases their margins since electronic trading is cheaper to administer and execute than labor-intensive manual trading. In addition, exponentially higher volume can be pumped through a machine than a human.

Another participant group that should be consulted are options traders. What happens if there is a big move in stock trading overnight and they can’t adjust their positions? Currently, everything is projected. It doesn’t actually print a mark on a tape. Options markets are a buffer for underlying markets and integral to them. If NASDAQ goes 24/7, then CBOE should be going 24/7 too, and in concert with each other.

He goes on to write that corporate participants in the market remain wary about 24/7 trading and you cannot blame them.

Suppose you are a CEO of a publicly listed firm. One rumor on social media can wipe out a lot of your valuation overnight before you have had a chance to marshal your company to respond. If there is anything common among public CEOs, it is that they don’t want to see continuous volatility in their publicly listed shares. They’d just like to run their business and grow.

It’s important to remember, there are stakeholders in the company that don’t give two shits about scalping a penny or two out of the stock. They own it because they think the stock will appreciate over time and pay them.

Imagine how a big overnight move affects employee morale. Sure, you aren’t supposed to look at the stock every day, but you can’t help but look at it sometimes. When a stock is continuously under selling pressure, it can sometimes be harder to attract new employees.

If there is a faction against 24/7 trading, it will be the public company CEOs. I do think they should be integral to the discussion. But remember when they speak, they aren’t just speaking for their own portfolio. They are speaking for their employees and their shareholders.

When it comes to trading stocks, I think the integrity of those groups outweigh the wants of the electronic traders and day traders.

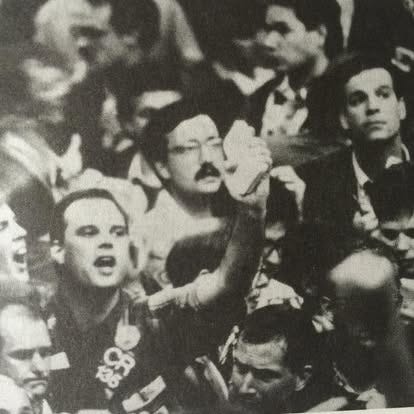

FWIW, yes that is me in the centerish of the photo (CR). Back month Eurodollars probably in 1988 or 1989.

You had hair back then.😄

#MeToo 😄

I also started in Euros in 1986.

Did not know you worked for Rodger who, along with Don Wilson and a few others including the Goldman boys, Jeff and Bruce, helped me get a lot done in Euro Options.

As a relatively frequent equity index options trader I agree with much of your assessment in the article and look forward to seeing how this all plays out in the next few months.

While I would appreciate an overnight market in the index options, I do recognize that the depth of absorption liquidity-wise is generally dramatically reduced, and that is one hell of an understatement, especially in the beginning, but it's better than nothing I suppose.