I saw Black Monday trending on Twitter. Most of the people tweeting about Black Monday weren’t alive for Black Monday. If they were, they were potty training or learning their colors.

TL:DR There will be no Black Monday tomorrow. No one, and I mean no one, can call a market crash like that. As a matter of fact, the dean of Finance Professor Eugene Fama said something really prescient to me once. “You only see crashes in the rearview mirror.” He’s right of course.

Fama and others are one of the reasons I love Chicago Booth. They simplify really hard concepts so you can understand them. Friedman, Becker, Coase, Miller, Lucas, Sowell, and now their students that actively adhere to the way the Chicago Boys formed their logical arguments make it easy to understand.

I was on the floor for Black Monday. I wasn’t trading just yet. It was October 19th, 1987. I started trading in May of 1988. I clerked for an options trader named Roger Carlsson. EMA was his badge and he was one of the best traders you have never heard of. I was his fifth employee. His previous clerk, Dave Vecchione (VK) was in the pit and I was behind him watching Roger, and his two other options traders Martha (MHM) and Gary (GR).

To say that the trading floor was bedlam that day is an understatement.

It was the single craziest day I have ever seen. I traded through 2008, LTCM, and other market dislocations. Black Monday is #1 and it’s not close.

I had outtrades that were only due to a keypunch error. My boss wrote down a price that didn’t match the broker’s price. Clearly, when I looked at the paper order duplicate, the broker was correct, my guy wrong. The change cost him $100k.

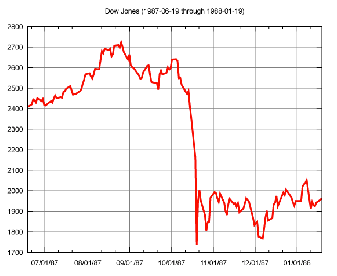

Stocks lost more than 20% in a single day. The 1929 Crash took two days to accomplish that. If you thought the Covid Crash was volatile, you’d never have made it through the 1987 crash.

I saw guys try and buy dips. “Let’s buy a one lot here”, they said. They were looking at charts and trying to find “support”. By the time they got their card back, they were out $25k-$50k.

Craig Pirrong had a post up that talks about what it was like in the back office. He was working for a friend of mine, Brian Monieson. Tom Sosnoff, one of the great all time traders and entrepreneurs, did a documentary about the crash called Cancel Crash. He credits Blair Hull, a legendary trader, for stopping the break.

The week before Black Monday was also volatile. Every day, the market was down and not by a smidge. The day after, Tuesday, was insane. Eurodollars opened 300-400 tick higher across the curve, at $25 per tick. Being naked short a 100 lot, which was kind of the average trade size in the pit, potentially could cost you $100K.

Two people who later became very good friends of mine sold 1000 each on the open. Within a minute they had covered them and made over $1MM each.

Imagine stepping into a pit after a hypervolatile week and then the worst losing day in stock market history and selling into one of the largest rallies in interest rate history. That’s what locals on the floor used to do and it took a gigantic set of balls.

My boss was usually short premium in the Eurodollar options. He’d sell the middle of the options curve, and buy the wings. As the market got closer to expiration, the premium that leaked out of the market would allow him to ring the cash register. It’s a very risky strategy. If you don’t have a very keen sense of the market, and don’t know where to go when volatility spikes, it is picking nickels up in front of a steamroller.

Two weeks before Black Monday, my boss got out of his shorts and got long vol. A lot of traders in the pit got shorter as vol spiked, and then some even exercised out of the money options to get even shorter.

It didn’t work out for them.

Sure. Things seem shitty now. Let us list the ways.

Treasury yields are high. To me, they seem normal. 8% mortgages aren’t “crushing”. They only seem crushing when you were used to free money. We had free money from 2008-2021. The Fed screwed up and I was vocal in saying they were screwing up.

We have a potential disaster brewing in Israel. We wouldn’t have a potential disaster if we had a President and an administration that was competent. The clown car running foreign policy in DC wants to give humanitarian aid to terrorists not realizing they won’t spend it on aid and will on weapons to kill Jews. Not only that, the clown car wants a “fair fight”. They see it as some sort of UFC cage match where the weights, size and reach need to match up.

Not only that, there are Republicans on board that are war mongering. Nikki Haley wants to fight in Ukraine and Israel, AND bring Gaza refugees into the US. How’s that going to work out? Little Lindsay Graham is calling for war with Iran. The Neo-Cons of the Republican Party created a gigantic mess in 2003 and we shouldn’t let them do it again. Some of the neo-con opinion people desire wars that they don’t have to fight in or send offspring off to fight in so much they became Democrats. Of course, they were always truly Democrats anyway.

We have a vacuum of leadership in the House thanks to 8 recalcitrant Republicans that didn’t learn the finer points of strategy, and act like terrible two-year-olds when they don’t get what they want. The alternative is having House leadership that supports Israel in words only, but wants to fundamentally change the US into a socialist state.

Government debt is a claim on the future earnings of citizens. It’s at all time highs and growing quickly. The higher interest rates are the more expensive it is.

Inflation is caused by government spending and we are spending an insane amount of money. The macroeconomic analysis you should use is not neo-Keynesian ISLM curve analysis but Y= C+I+G classical analysis where G=0.

Taxes are high and going higher. Instead of embracing the Fair Tax, every politicians embraces “if it moves tax it, if it stops moving create a tax that funds a government program to get it moving again so we can tax it.”

Regulations are rampant, and costing us money every time we turn around. Free markets are under attack and people are starting to feel hopeless.

So, sure, I can see why people are calling for a Black Monday crash. But, I don’t think they truly want a crash. They want a bloodletting to make all the hurt I listed above go away.

Humpty Dumpty doesn’t get put back together with Black Monday. It splinters further. You put Humpty back together by putting pro-free market, low tax, low regulation policies in place that encourage growth. One political party is against that and it starts with the letter D. The other party sort of gets it, and it starts with an R. Marc Andreessen gets it. How about you?

Few understand this…..

I forgot to include a story. https://x.com/NeilJacobs/status/1714971755331170617?s=20 here is Tudor Jones on the day of the crash. He came into Black Monday short S+P futures, as many as his account could hold basically. On Tuesday morning, he called his broker on the floor of the CME. The guy was a very eccentric guy. He told his broker he wanted out of every single short by the end of the day. His broker said okay-and Jones said, you can take your time if you want. Go as you see fit.

The market opened that day and on one side of the S+P pit it was offered 100 handles off from the other side of the pit which was bid. The broker covered all the shorts at the low of the day.

After the close, Tudor sent a limo to the broker. They drove him to a Mercedes dealer. They told him to buy whichever one he wanted. He did, and unfortunately I cannot remember the vanity license plate he put on it....others might be able to fill in that blank if they read this.

All I can add is "AMEN"! The government at all levels needs to be reigned in and get the hell out of the way of people who will be productive if just given the opportunity. Also quit spending money funding the endless wars.

I don't think the Fed will allow another Black Monday to ever happen. Instead they are focused on stealing us blind with non-stop money printing.

Your point about interest rates is spot on. Interest rates are normal now, they were out of whack for the last 15 years. We are going to pay a high price as a society for all the central planning shenanigans.