Decentralized Clearing

Will It Work?

A little-reported hearing took place on May 12 at the House Agriculture Committee. However, it’s outcome will affect you.

The topic was the clearing of derivatives. It’s pretty boring mundane stuff to 99.99% of the population but integral to prices at the grocery store, the rate of interest you pay, and prices at the gas pump.

FTX, the upstart crypto exchange wants to use different methods to clear derivatives trades. The House Ag Committee is looking into the potential risks with a system like that.

CME Chair and personal friend of mine Terry Duffy testified. We were on the board together but more importantly, we traded lean hogs in the same pit. It’s where you see the true mettle of a person and he is an honest guy. He and I don’t always agree. We sometimes found ourselves on opposite sides of issues. As with most testimony like this, it’s all pre-written and scripted until the random Q+A portion of it. Here is the scripted headline statement.

"FTX's proposal is glaringly deficient and poses significant risk to market stability and market participants," Duffy said. "FTX proposes to implement a 'risk management light' clearing regime that would significantly increase market risks by potentially removing up to $170 billion of loss-absorbing capital from the cleared derivatives market, eliminating standard credit checks, and destroying risk management incentives by limiting capital requirements and mutualized risk. Under false claims of 'innovation,' FTX's proposal is nothing more than cost-cutting measures that would come at the expense of risk management best practices, market integrity, customer safety and, ultimately, financial stability."

I will lay my cards on the table. As a former CME Board member and independent trader, I know the full value of clearing. When we demutualized, we saw it as a strategic asset and that has proven out to be the case. We took a $200MM dollar exchange and created an $80B behemoth and a lot of that is due to owning clearing.

I also know that the benefits of clearing can be overstated when you are trying to clear OTC derivatives. Craig Pirrong at Streetwise Professor has written extensively about that.

Why is this important to the average Joe?

Some sort of clearing system underpins every single transaction you engage in. Credit cards have clearing. Banking has clearing. Trading has clearing. Clearing is the backbone of the entire financial system.

When I encounter a new startup exchange, the very first question I want them to answer so I can analyze the business is “How are you going to do clearing and settlement?” Front-end trading systems can be downloaded from the internet. They are easy. Clearing is hard.

Currently, clearing is generally a closed network. Even when clearing is seen as a utility and not an asset, like it is in the listed options market, clearing is a closed network.

It’s closed and centralized to stop fraud, to make sure everything runs on time and in order. Huge institutions and trillions of dollars flow through clearing systems every day. You don’t even know it’s happening behind the curtain until something goes terribly wrong.

In 1987 after the stock market crash, JP Morgan almost didn’t make their margin call from the prior day. They made it in the nick of time and the market was able to open but it would have been a disaster if they didn’t. One of the biggest issues with the MF Global scandal was that money which was used by customers to margin positions was used by Corzine to margin his position. You can read more about it here.

Clearing makes sure that when settlement happens, the price is transparent and both parties to the transaction do what they say they are going to do. There are penalties if they don’t. Imagine if when you purchased something with your credit card and the goods never showed up-or you didn’t pay? There are consequences.

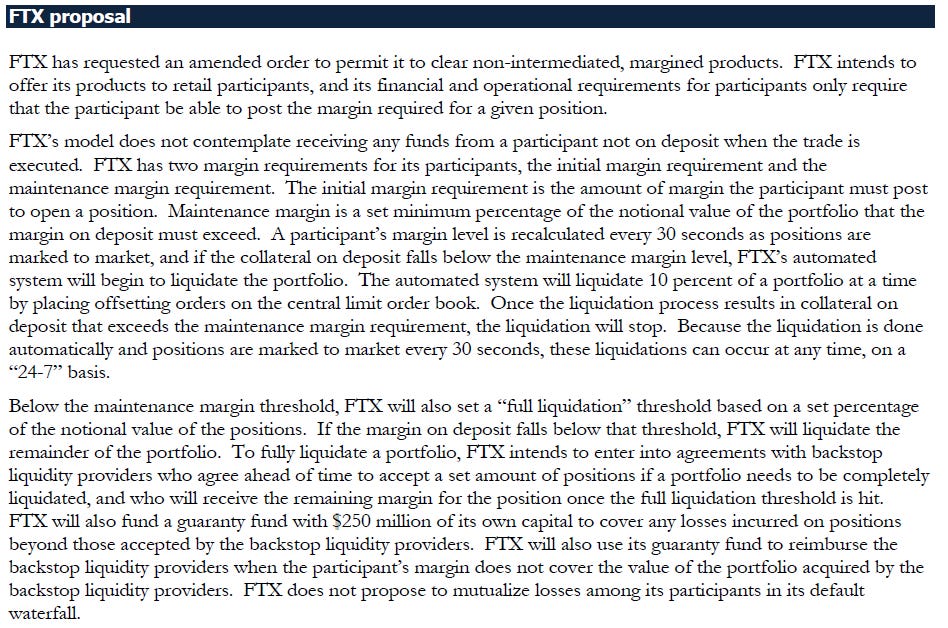

The radical thing FTX is proposing is opening the network up. Decentralized clearing. Here is their exact proposal.

Logically, this sounds great. We all prefer open to closed. Closed sounds like a snobby club we can’t be in. But, the closed network of clearing washes away a lot of risk in financial transactions. On the floor, I used to trade millions of dollars of the notional value of contracts every day and I didn’t worry a lick about whether the other side of the trade was going to be good or not. If there was a problem, it wasn’t with the clearinghouse.

It’s pretty clear that the existing exchanges that own their own clearing systems would have a problem with a radical change to clearing. Back in early 2009, a person at the Department of Justice leaked an internal memo that said they were ripping clearing from CME and the stock dropped $150 in one day. Conveniently, that person went on to become CEO of a bank in North Carolina and had his bank account feathered.

But, there is a reason exchanges own their own clearing besides financial integrity. It gives them a true incentive to innovate. What incentive would they have to create new contracts if they couldn’t make money from clearing them?

I do agree that the exchanges need competition from upstarts. It’s too expensive and arduous to create an exchange. Building your own internal clearinghouse probably starts at around $100MM dollars.

Cross margining of contracts inside a captive clearinghouse creates a competitive moat to potential competition when it comes to capital efficiency.

What happens in a decentralized system? This article from Forbes explains it in more depth than I will go into here.

I see large risks in going direct to customers and collecting margins from them without an intermediary. In closed systems, the intermediary is on the hook if the customer can’t pay. What happens with the FTX proposal? There could be trades left out to blow in the wind.

In customized derivatives, or OTC markets, there is a lengthy due diligence process that each side goes through before they enter into a trade. People got a flavor of that if they read the book “The Big Short” or saw the movie. The investment bank investigated everything about the other party before they did the trade and farmed it off to clients. The investment bank also handled settlement and demanded cash as the trade went against the short. Michael Burry was almost broke until he wasn’t.

I also see risk in the relationship that FTX has with backstop liquidity providers. How do we know they can remain liquid? As I said above in the crash of 1987, the biggest Wall St banks were stressed to make margin. They had to turn to the Federal Reserve. In 2008, we saw long-time firms such as Bear Stearns and Lehman go under due to lack of liquidity. Warren Buffett bailed out a couple of banks and taxpayers had to bail out banks so they would remain solvent.

In a closed network system, a central authority (an exchange) has an algorithm that it uses to calculate risk. It charges a margin based on that calculation. If you want to hold a position in a contract, you put up a fraction of the actual dollar value of that contract.

When the NASDAQ futures got super volatile in 1999-2000, at CME we instituted margining twice per day. I think margining at least twice or several times a day is the standard operating procedure now at exchanges with 24/7 trading and volatility. But, I am not an insider so I don’t know.

With the advent of artificial intelligence and technology, risk analysis and the movement of funds across networks have gotten more precise. However, not precise enough for FTX.

Their argument is that instead of having intermediaries like brokerage houses manage relationships with customers, exchanges ought to be able to go direct to consumers and execute.

Ironically, we had that exact debate extensively way back in 1999 in the CME Strategic Planning Committee. Folks that were on that committee with me can feel free to speak their mind down in the comments. The core question was this, “Should we (CME) disintermediate traditional brokerage when we demutualized?” We decided not to for a lot of reasons and at the time it was the right decision.

But, we could envision a world where it was possible. Disintermediation is an easy thing to say. Operationally it becomes extremely complex and expensive.

FTX wants to go direct. It is selling the “we margin 24/7/7” theory because crypto markets never close. They are selling their artificial intelligence and their algorithms as secure and better risk management. But, just because a market never closes doesn’t mean on the run margining is the most efficient way to operate. Plus, all of the old fuddy duddys don’t really understand the new cool stuff, do we?

Regular exchange-traded futures markets are mostly open 24/7. They are shut down on Saturday and part of Sunday. But, every day they have a settlement and they mark to market and margin to that settlement. Pays and collects happen.

Here is where the FTX argument breaks down. Traditional exchanges require government fiat cash to secure positions. FTX on the other hand wants this,

With CME, you are not able to post Bitcoin for collateral. You must post cash and so there is a capital efficiency problem if you want to trade Bitcoin versus Bitcoin futures. Our aim is to be able to integrate the spot and the derivatives platform together under one roof.

What happens when the value of BTC drops precipitously? Bitcoin’s value moves around significantly more than US dollars or other fiat currencies. Not only that, it’s considered a commodity and most of the world doesn’t hold BTC.

Today, despite the claims on notional numbers, crypto is a small market. The proponents of that market hate to hear that but it is true. I also “get” that Bitcoin is theoretically not inflationary and has a lot of benefits that fiat doesn’t have. But, it’s only backed by a network. Networks can disintegrate. The armageddon that Bitcoin enthusiasts propose could happen, but the probability of their version of armageddon is not likely at all.

There are reasons for Bitcoin and cryptocurrencies like it to succeed other than just being a medium of exchange. I own several cryptos and think they will be valuable someday.

FTX makes the point that the risk inside the CME clearinghouse is unknown to outsiders. While true, is it a big deal? There are several layers of protection for customers unless you get an unscrupulous operator like Corzine. When I was on the CME board, we went from a “good to the last drop” type of clearing to an insurance policy backing the risk in the clearinghouse. CME and ICE carry insurance in case of large defaults. They also are very transparent with margin, and the way it is calculated. Open interest, large trader positions, and things like that are publicly reported. FTX might but has not specifically said they will be wide open about all kinds of data in the market.

Clearing does provide a value-added service to customers, and the cost is relatively cheap. There is no doubt that investment banks and trading firm would like to see lower clearing and exchange fees, but the main ones they really bitch about is data fees. For them, clearing is cheap.

Going to an FTX system probably would force the big institutions to increase their internal costs for risk management.

FTX makes this unrealistic point: A bigger concern is for people who keep waking up at 4am to find that 10% of their position got liquidated. It is the farmer who bought a corn future and suddenly because of three days’ worth of price movements, wakes up by Monday to find that the price of cows has suddenly moved 10% in a very discontinuous fashion. And their entire position gets liquidated at once.

No one is surprised when their position is liquidated. They have full warning to put cash up to hold the position. When I was trading, and I didn’t have enough cash, someone from my firm would tell me to either get my position down, or deposit cash. It wasn’t a shock. If markets are volatile, and you have a position, you know it.

What would the FTX futures system have done with the total collapse of the cash UST/Luna token? Would it have been orderly? What happens to volatility in markets where margins are recalculated every 30 seconds? All of a sudden, the price moves against me and I am forced to sell to what buyers?

The existing system builds in buffers.

I go back to 1987. It was the most devastating day in the US financial system since October 1929. Nothing since 1987 rivals it. From the Federal Reserve Paper I linked to above, who does the following in the FTX system?

2.3 Tuesday, October 20, 1987

Before the opening of financial markets on Tuesday, the Federal Reserve issued a short statement that said:

The Federal Reserve, consistent with its responsibilities as the Nation's central bank, affirmed today its readiness to serve as a source of liquidity to support the economic and financial system.

Model out a similar breakdown of crypto to 1987. Who will give the market the safety and confidence to come in and trade after a collapse?

I agree wholeheartedly with FTX's position that is incredibly archaic, long, and expensive to go through the government process to obtain certain licenses. I think this process can be streamlined and made a lot more efficient. As a CME board member, it was frustrating just to go through the process to get new contracts approved. As an investor in Bitnomial, I saw firsthand the process, cost, and time to market it took to get their designated contract market (DCM) license. It is incredibly painful and more importantly bottles up the potential competition.

I am a big believer in competition. CME and ICE control almost 100% of the listed futures market and having upstart competition is a great idea just like it is in every other business vertical the government uses heavy-handed regulation in. The fact that FTX is spurring this conversation is the right thing to do. I’d like to see more testimony from them in front of Congress and more comments at the CFTC on how their system would work. We’d also probably want to see legal contracts and bank accounts, and insurance policies that back up the system. No matter the business vertical; Banking, Insurance, Energy, Education, Liquor, or Medicine, the government mostly screws it up and puts a monkey wrench in the process.

Efficiency tends to win and monopolies will forever be attacked. There's a great deal of fat in TradFi futures (hello FCMers) and it needs to be trimmed.

Will the FTX model fly as is? Unlikely. Will if force change? Pretty certain it will. What will we get? Faster settlement. Cheaper (fee?) data. More responsive regulatory bodies (responsive is key...not more regulatory bodies, please!). A more consumer friendly version of securities lending. More rapid development of needed trading products (dangerous, agreed0...an a whole lot more.

I admit, I'm biased as I moved over recently to 100% crypto after 30 years in TradFi (futures, mostly) but the issues I've listed are a short list of reasons for why I made the move. TradFi isn't evolving fast enough and that has softened its roar. There, I said it. TradFi is soft.

I think it's time to consult with Jon Corzine for the answers to all of the above. He's your answer man with no downside. I wonder what kind of mayhem that guy would have spun with crypto futures in the portfolio?