Over the years, I have seen reports of Congresspeople and their staffs trading. They’d trade commodities. They’d trade stocks. They’d get in land deals. The other day I saw a report that Dallas Federal Reserve Governor Robert Kaplan was trading his own account. Boston Fed official Eric Rosengarten was also trading.

Predictably, Senator Elizabeth Warren, no fan of capitalism and free markets, said that Fed officials ought to be banned from owning stock. I saw no such pronouncements from the distinguished Senator from Massachusetts when Nancy Pelosi’s husband was wheeling and dealing in the stock market during the pandemic. That guy has amazing market timing.

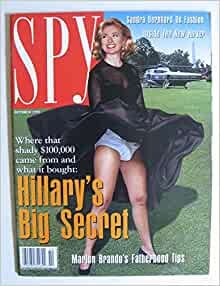

Of course, we all know Hillary Clinton is an accomplished cattle trader. All that happened here was a political payoff. She took the good side of a spread and the Tyson’s took the bad side.

I will tell you I was in a conversation with former NY Senator Alphonse D’ Amato once who told me “some guy named Ziffy” used to send them checks from trading stocks at the NASDAQ. Don’t worry, I have witnesses to the conversation.

It’s not just Democrats and Fed officials that game the system. It’s everyone.

Former Speaker of the House Dennis Hastert was quite the real estate developer. He just happened to always buy land in the right place at the right time. North Carolina Senator Burr was quite the mensch when it came to trading stock during the pandemic too.

Even though Congress has passed rules against it the stuff still happens.

Oh and of course, there are rules banning a lot of the American public from investing in certain things unless they are accredited investors.

Here is the answer to the problem.

It’s a known fact that buying index funds is better in the long run for the average investor when it comes to investing. See Professor Eugene Fama’s research which has been poked and prodded in many different ways over the years but still comes out on top. You can’t beat the market unless you can create an edge for yourself. Traders all over the world use different methods to try and create that edge but the only edges we know for sure that work are speed and inside information.

You don’t need a money manager to invest in index funds for you. You might need a money manager to help you organize and structure how you draw down those funds in retirement in the best tax-advantaged way possible.

The answer is index funds as investment vehicles only for all federal employees and elected officials. There are enough index funds that they can be diversified.

If the S+P 500 does well, generally most of America does well.

But, what about the wealthy people that have other assets prior to becoming an elected official or employee?

Blind trusts and I mean truly blind trusts. That person can’t initiate or get out of any positions once they take the oath of office or assume the responsibility of the role they are appointed to.

There will be conflicts. Suppose I am a venture capitalist invested in a bunch of start-up medical companies. I have a lot of expertise in medicine. They want me on a committee to oversee medical. That’s a no-no. You certainly can testify in front of that committee and share your expertise. But, you have to disclose which companies you are invested in, and how much ownership percentage you have-along with some sort of independent analysis of how your vote will affect the future of that company.

The other thing that would go a long way to stopping a lot of the bullshit that happens is term limits and applying Glenn Reynolds’ lobbying tax.

We have lost faith in our official and our non-government institutions. It’s clear they and the people that run them are corrupt. It’s time to stop the corruption otherwise we risk not having any form of government anyone respects and it will be the end of civil society.

Another way to fix the problem: force our politicians to #BetOnTeamUSA https://cjshaver.com/bl0283/