I am laughing. Laughing so hard. ESG investing is having a moment. Long-time readers of my blog will remember I called bullshit on ESG years ago. As a matter of fact, at the i7/G7 in Torino, Italy I was pretty unpopular when ESG was a topic of conversation.

No one could tell me the GAAP accounting rules so I could compare and contrast companies on their ESG returns.

I admit, using the word “return” combined with ESG is a stretch since as soon as a company focuses on something other than building a great business and returning capital to stakeholders, it’s not really focused on return.

ESG is just crony capitalism with a different name. Cleaned up with a pressed shirt and tie. If there is free money lying on the ground, someone somewhere will try and contort themselves to get it.

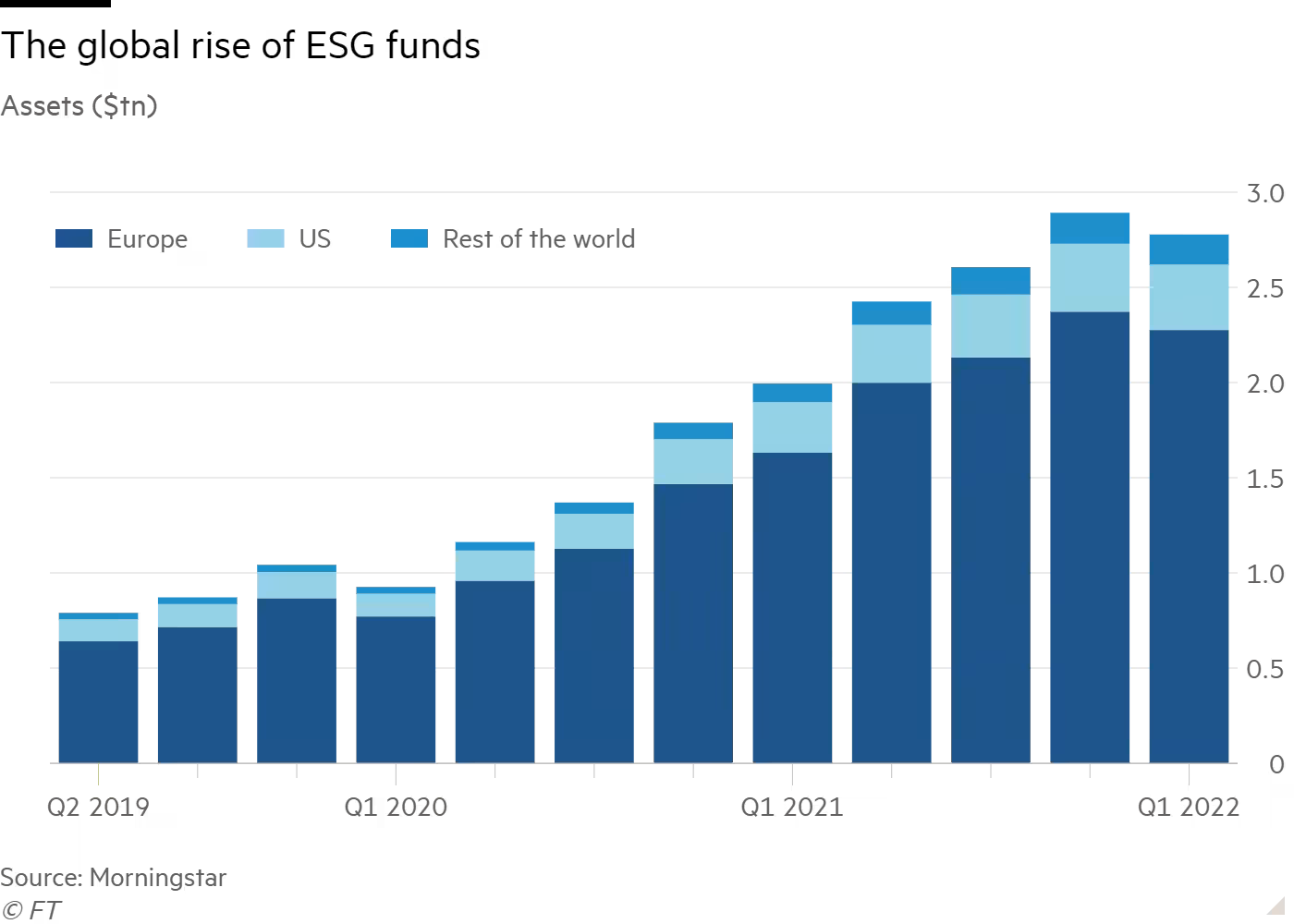

You can see by the money flow it caught on in Europe big time. Hehe, there is a reason why we abandoned Europe for the New World all those years ago. Most of us think differently. The US has held relatively constant since the end of 2020. In the US, that money is the uber liberals. The blue checks. That’s limousine liberal champagne socialist cash and the acolytes that want to be like them.

The champagne socialists will toss some money into an ESG fund to look good at cocktail parties and lunches. But, believe me the bulk of their portfolio is in stuff that pays.

Now comes “greenwashing”.

Greenwashing is when a company overstates its ESG credentials. These are the environmental, and social goals. They don’t tell the truth to either the public or investment advisors. That way they can be included in ESG-focused funds.

But this is what really has me laughing. In the Financial Times today, I read this:

On top of the allegations of greenwashing at the industry’s highest levels, there is the impact of Russia’s invasion of Ukraine, which is forcing companies, investors and governments to wrestle with developments that at times appear to pit the E, the S and the G against one another. For example, governments in Europe are reneging on environmental goals by turning to fossil fuels to reduce dependence on Russian gas, in order to fulfil ethical goals. “The war in Ukraine is an incredible challenge for the world of ESG,” says Hubert Keller, managing partner at Lombard Odier. “This conflict is forcing the questions: what is ESG investing? Does it really work? And can we afford it?”

Is the war in Ukraine an “incredible challenge” for GAAP accounting principles?

No.

The bureaucrats and non-government officials that advocate for ESG will try and “fix” it. They try to fix everything. The policies and precepts they hand down always need fixing because they go against human nature. Like a dumb spider, they weave these stupid webs and always get caught in them.

They need the gravy train of money coming to them to keep flowing so idiotic ideas like ESG investing will never go away as long as people fund them.

That is why a lot of terrible ideas have no time-stamped end date on them. They can be made to seem logical. The “fairness and equality” of Marxism sounds great until you see it put into practice.

Hey American corporations, see what your donations to the Marxist-led Black Lives Matter bought. You simps. You were duped.

Investors that follow ESG make absolutely backassward decisions. For example, the country of Latvia couldn’t get loans from banks in Sweden to spend money on defense. In a Western civilized society, the reason you spend money on having a great army isn’t to be able to invade and conquer other countries. It’s to preserve your freedom so no one invades yours.

The FT concludes, and I love it:

“We must not mix up ethical with ESG, because they are two separate things,” says Saker Nusseibeh, chief executive of Federated Hermes. “Being ethical is the prerogative of the client.

Hahahahaha. I am laughing harder. My belly hurts. Value judgments and ethics are on a continuum. You might have different values than me, and there is no way to codify that into a hard and fast policy that every company can use to report financial information and make decisions. This is one input into supply and demand curves.

Lawyers are for value judgments and ethics and it is one reason why they are hated. Two lawyers can look at EXACTLY the same facts and conclude outcomes differently. Often there is no penalty or consequences for the difference.

When the crap hits the fan, people want return. If there is one good thing about the inflation we are experiencing is the cold slap in the face it’s giving to a lot of ideas that are simply stupid and misplaced, like ESG.

Mr. Market does things differently. My hope is Mr. Market disciplines the ESG crowd mercilessly.

investing is less efficient forms of energy surprisingly leads to less efficient returns on investment ... someone should sue the pants off the ESG managers for ignoring their fiduciary duty to the investors ... a client who will be dead in 10-30 years doesn't need or want a 50 year investment horizon ... and all the ESG nonsense aims at saving the planet in 50-100 years ... (one sign of a scam is the long horizon with no way the measure intermediate goals, and sketchy faulty "models" ...)

One benefit of inflation is that will cause a reevaluation of the malinvestment that occurred under ZIRP. Painful, very likely. But as Buffet (or someone said), when the tide goes out, those swimming naked are exposed.