Financial Misinformation

People Do Not Understand Finance

One of the reasons I started blogging back in 2010 was because I saw Dodd-Frank moving through the halls of Congress. I recognized that it was one of the worst pieces of legislation in American history, and that because of the refusal of everyone to admit the real causes of the 2008 Financial Crash, it was liable to pass.

It passed. It’s terrible. If you want to know how terrible, search Craig’s blog. He calls it “Franken-Dodd”. Apt description. Meanwhile, people still do not have a clue what they are talking about when it comes to finance.

A current example is the $20 billion deal by the US Treasury with the Argentinian government. Hint: It wasn’t a purchase.

“It’s a bribe.”

“It’s going into Mileil’s pocket.”

“It’s a bailout.”

Then there are the false equivalences.

“Our soybean farmers are hurting from Trump’s tariffs, and they just gave $20B to Argentina.”

“People are starving in the US, yet you give Argentina money.”

“The US government is shut down, but you can give Argentina money.”

Plenty more where that came from.

Let’s look at what is actually going on. The US Treasury didn’t buy $20B worth of Argentinian pesos. They set up a swap facility, a big difference. Here is business news.

The @USTreasury has concluded 4 days of intensive meetings with Minister @LuisCaputoAR and his team in DC. We discussed Argentina’s strong economic fundamentals, including structural changes already underway that will generate significant dollar-denominated exports and foreign exchange reserves. Argentina faces a moment of acute illiquidity.

The international community – including @IMFNews– is unified behind Argentina and its prudent fiscal strategy, but only the United States can act swiftly. And act we will. To that end, today we directly purchased Argentine pesos. Additionally, we have finalized a $20 billion currency swap framework with Argentina’s central bank.

The U.S. Treasury is prepared, immediately, to take whatever exceptional measures are warranted to provide stability to markets. I emphasized to Minister Caputo that @POTUS@realDonaldTrump’s America First economic leadership is committed to strengthening our allies who welcome fair trade and American investment. I continue to hear from American business leaders who, thanks to President Milei’s leadership, are eager to tie the American and Argentine economies more closely together.

The Trump administration is resolute in our support for allies of the United States, and to that end we also discussed Argentina’s investment incentives, and U.S. tools to powerfully support investment in our strategic partners. Minister Caputo informed me of his close coordination with the IMF on Argentina’s commitments under its program. Argentina’s policies, when anchored on fiscal discipline, are sound. Its exchange rate band remains fit for purpose. We reviewed the broad political consensus in Argentina for the second half of President @JMilei’s term.

I was encouraged by their focus on achieving fiscally sound economic freedom for the people of Argentina via lower taxes, higher investment, private sector job creation, and partnering with allies. As Argentina lifts the dead weight of the state and stops spending into inflation, great things are possible. The success of Argentina’s reform agenda is of systemic importance, and a strong, stable Argentina which helps anchor a prosperous Western Hemisphere is in the strategic interest of the United States. Their success should be a bipartisan priority. I look forward to the meeting between President Trump and President Milei on October 14, and to seeing Minister Caputo again on the margins of the IMF Annual Meetings.

Argentina under Mileil isn’t the Argentina of the past. Mileil is a radically free-market person. I dig him. It takes years to unwind more than a century of terrible economic policy.

Remember tariffs? Mileil was the first to tell Trump zero tariffs. That’s going to increase the level of trade between the US and Argentina. Hence, it behooves the US Treasury to own pesos and Argentinian debt on the expectation that trade will increase. There was already an incentive for the US Treasury to act.

The US went into the market and bought pesos, creating liquidity for Argentina. It backstopped it with a $20B swap facility, where US Dollars and Pesos can be continuously swapped back and forth as needed. It’s not one way.

Here is the classic definition of a forex swap facility from Grok.

A forex swap facility, also known as a central bank liquidity swap or swap line, is an agreement between central banks to exchange their respective currencies temporarily. This provides liquidity in a specific foreign currency (often U.S. dollars) to institutions in one jurisdiction during periods of market stress, helping to stabilize global financial markets and prevent the spread of liquidity strains.

How It Works

These facilities typically involve two simultaneous transactions:

Initial Exchange: One central bank (e.g., the Federal Reserve) provides its currency (e.g., USD) to another central bank (e.g., the European Central Bank) in exchange for the latter’s currency at the current market exchange rate. The receiving central bank then lends the borrowed currency to financial institutions in its jurisdiction.

Reverse Exchange: The parties agree to unwind the swap on a future date (e.g., overnight to three months) at the same exchange rate, with the borrowing central bank paying interest at a market-based rate.

This structure expands central bank balance sheets temporarily but ensures no net change in currency holdings, as the exchange rate is fixed for the unwind. The borrowing central bank assumes the credit risk of any loans it extends.

Purpose and Examples

Primary Goal: To act as a backstop for dollar funding markets abroad, easing strains that could affect economic conditions and financial stability.

Key Networks: The Federal Reserve maintains standing swap lines with major central banks like the ECB, Bank of Japan, Bank of England, Swiss National Bank, and Bank of Canada. Similar arrangements exist among other central banks (e.g., via the North American Framework Agreement with Mexico)

There are some other things afoot here. Bessent said that because of what Mileil is doing inside Argentina, he feels that the Argentinian peso is severely undervalued. The market hasn’t caught up. Part of that is the bias of the past. Argentina has gone bankrupt a few times, leaving financiers in the lurch. Pardon the market for not becoming a true believer. Instead, it thinks Lucy is holding the football.

A key to this is the fixed exchange rate on the swap. This is not speculative, but just Finance 401. It is not Finance 101. It is a bet on the creditworthiness of the Argentinian central bank. You have to trust that Bessent did his due diligence.

After all, Bessent was one of the best macrotraders in the world prior to taking this job. I think we ought to have a bit of confidence in him. He wasn’t a maverick scalper just looking at lines on a chart. He understands the guts and the glue and the flows of finance.

People are attacking Bessent and Trump for not being “America First!” In fact, stabilizing a trading partner’s economy in this way is being America First because, in the short and long run, America will benefit. Having a free market democratic nation in the Southern Hemisphere where communism is often popular is a good idea.

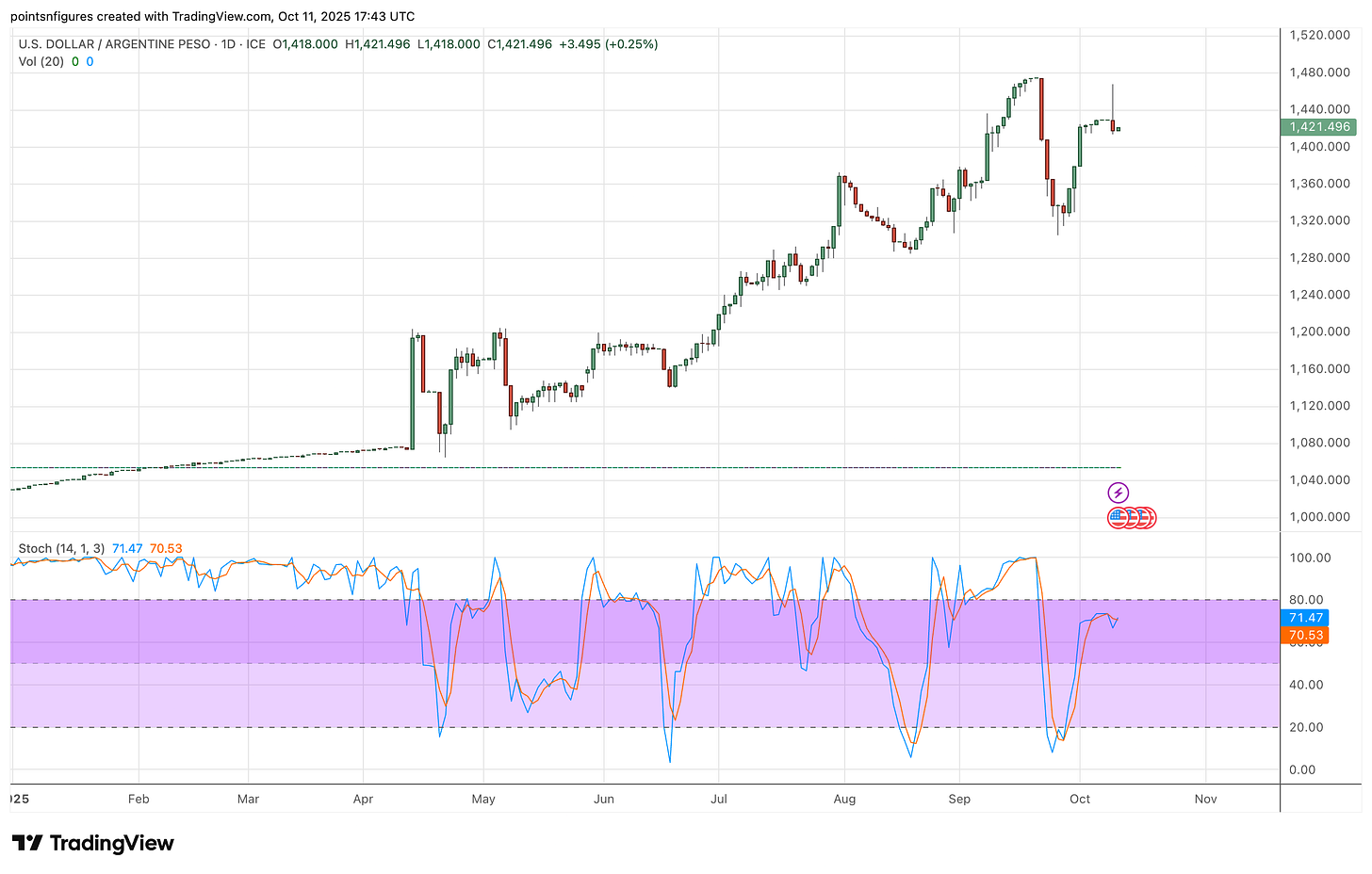

The peso has been crashing against the US dollar. It’s good to stabilize a valued trading partner so contagion doesn’t spread through the region.

This is not the only swap facility the US has set up with trading partners. It’s also not permanent. They are there to stabilize things until they aren’t needed. If you have faith in capitalism and free markets, as soon as Mileil gets that established country and industry-wide in Argentina, the swap facility won’t be necessary.

Swaps are done all the time in every financial market. The US debt market is fueled by swaps done between hedge funds and banks, banks and banks, and any other major financial entity you can think of with another major financial entity. The idea of a swap is not radical. It’s basic blocking and tackling when it comes to risk management. But, like I said above, it’s not Finance 101, but it is Finance 401.

Here is a chart of the US Dollar’s value relative to the Argentinian Peso. Remember, this chart includes the inflation the US has experienced, which has devalued the dollar! The dollar has climbed in value relative to the peso.

In a microeconomic sense, now would be a fantastic time to go to Argentina. The US dollar should go a long way. Great wine and food. Great culture. Spectacular coastline and amazing fly fishing. Wonderful hiking in the mountains. Amazing leather goods. Plus, you can learn the tango.

OK. So, what's the trade for a US investor to take advantage (to speculate on the outcome) for an improving Argentine peso/Argentine economy? Want to own Argentine stocks in peso terms isolated from/hedged against the dollar? Or is that trade gone with the Treasury swap? Call me curious.

It is a wise and shrewd move and will pay dividends down the road. Multiple benefits and those who don't see it probably don't have a good grasp of economics and politics, or have allowed their political biases to supersede their sensibilities.