Game On

The Brass Knuckles are Punching.

The gyrations in the stock market are pretty intense. But, for those not in the know, the stock market is the little brother to where the real trading takes place. The media reports on the stock market because it’s easy. It’s understandable. People know brand name companies.

They don’t understand bonds. They don’t understand FOREX. Those are the big daddies and slap the stock market around just to remind the stock market that they actually run the show.

The FOREX market trades multiple trillions of dollars each night and day. Debt market is next in size, followed by the stock market. When I traded Eurodollars back in the late 1980s and 1990s, our human pit traded more in notional dollar value during one day than the New York Stock Exchange did in an entire year. Eurodollars were only one aspect of the entire US debt market.

This whole thing is a gigantic game of chicken, and I have never thought tariffs were the right strategic lever to make the first move in it. The end result probably won’t be what people want it to be or think it will be. I do agree with Craig Pirrong that it’s game theory and not classical economics. But game theory incorporates strategy, and I think the strategy of the Trump team on tariffs was clumsy in the way it was applied.

I will give Trump a wider berth, though. Let’s see what happens in the next 90 days. He has to get a lot of great trade deals, or he will be a lame duck. The Democrats aren’t on his side and are cheering the Chinese on.

I will try to help people understand what I am hearing and what I see, but it is pretty complex. Currently, the interbank market, the corporate debt market, and the muni-debt market are frozen. It is similar to what happened in 2008, but it’s not the same because I think there is a lot more transparency now. In 2008, no one knew where the next bomb was going to blow up, but today, we know where they all are. At least, we think we do.

When markets stress, you never know who’s been hiding things in accounting, but they come out.

Bond market interest rates move inversely to price. Higher prices in interest rates mean lower rates….lower prices mean higher rates. When you see the charts below, remember that.

The US's vulnerability is the national debt. It’s been that way for a long time, but was severely exacerbated by Covid, then Biden. Even though the Fed retains control over the discount rate, the market retains control over what it actually costs to borrow and service the debt. This is why you might hear about the “Bond Vigilantes”. In conspiracy theory land, Covid was put out by the Chinese to get rid of Trump and blow out worldwide deficits so the Chinese could grab power.

At the same time, classical economists and very sharp people like Cliff Asness tweeted out that the US should spend anything to stop Covid. They were very wrong. Covid was not serious to the bulk of the population and the damn vaccine was so bad they changed the definition of the word vaccine just like they changed the definition of the word recession for Joe Biden.

What is the breaking point in terms of interest rates where the US cannot roll debt, cannot service debt, and has to default? Given the environment, they can’t go to taxpayers and ask for more money. Are you going to pay to service this, especially after DOGE has revealed all the fraud, grift, and waste?

Nope.

If the US defaults, what happens to the US dollar? It loses reserve currency status, we have hyperinflation, and the dollar isn’t worth much.

If you don’t understand the concept of debt using macroeconomics, you can look at debt another way. In startups (or a company), you have equity. You can do basically whatever you want as long as your board agrees or shareholders vote and support you. If the equity value goes up or down, it’s not a huge deal unless someone wants to sell it.

But try that with corporate debt. A company that issues debt has a new master, and it’s the bank. Sure, you can feel good about not diluting equity holders. If you can’t pay the debt, they take the company. Same with an economy. That’s why the debt-to-GDP ratio is important.

I think in this game, it is also important to remember the Chinese are communists. I don’t give a rats ass that they say they only have 24 months of welfare, that different regions can do different things blah blah blah.

No one has the upper hand in this game yet. They all are jawboning that they do, but the reality is they don’t. Right now, there is a FOREX “flight to quality” to the EU. Their goods just got a lot more expensive, and they don’t love that. They’d like to be at parity to the US dollar. But capital has to flow somewhere, and now they are it.

The Chinese have to be worried. They have a lot of problems. If their currency goes to zero. They have to keep the dollar peg, and they need the US consumer unless they can quickly infiltrate other markets. But, if I am the EU or another G-20 country with a decent consumer base, do I want the Chinese?

Their economy is slow, and in recession. Tariffs hurt them badly. They have a ton of debt themselves, issued by the communist government to cronies who built cities to nowhere and other things. That debt has to be paid.

It goes without saying that there is graft in the US government, but the grift/graft/corruption in a communist government like China’s is exponential.

What happens if businesses redeploy their factories out of China to other countries? Where are those people going to work? How are they going to get money to live? In a communist country, the government has to pay them. Or get overthrown. That means the end game for Xi is death.

The Chinese need to keep the yuan weak relative to the dollar. The Chinese manipulate their currency like crazy to keep it that way. They also allow very little to be imported unless it is food. Remember, the Chinese bought the largest US hog producer in the world, Smithfield. It’s about food, not anything else. They have a strategic pork reserve.

The Chinese steal. They cheat. They take intellectual property.

Here is where we are today, but it could change by the time you read this!

The market is crushing the ten-year note. Almost 4.5%…remember a few days ago it was trading 3.99% and everyone (Chamath) was saying this was Scott Bessent and 3D chess to roll trillions in debt. You don’t roll trillions in debt in an hour.

Who is selling? Supposedly, the Chinese are selling a bunch of their Treasury inventory. They get USD in return for selling products to the US, and redeploy them into UST because of the yuan-dollar peg. However, they don’t have the inventory that they used to have years ago. But they still have a lot of it, and it will hurt.

There are also basis trades unwinding. Here is a quick and dirty basis trade explanation. More complex basis trades will be intracountry. You used to be able to sell Japan Treasuries and buy US Treasuries for a profit, and then arbitrage between the Yen/Dollar spread to keep it in line. Essentially, you were short the Yen against the Dollar. This is a very, very good friend of mine’s blog. He quit blogging but his last one was a year ago on the Yen/Dollar carry trade.

Yra was one of the best currency traders on the floor. Wonder what he thinks today.

The short-end of the curve (SOFR, T-bills) isn’t getting pounded as badly. But it’s under selling pressure.

On the US Treasury site, you can chart the yield curve daily. But, it doesn’t reflect the traded market. It’s a point in time. Here is a chart for the 10-year. The bars on the bottom show the volume in red/green. The more the volume, the higher the market interest regarding the move. The move from 114’00’00 to 111’16’00 was a huge move with huge volume.

2 year note futures were NOT the same. Volatile, but not like the longer-dated treasuries. Wait for some dumbfuck to crow that Yellen was right in shortening the duration of American debt because volatility is lower.

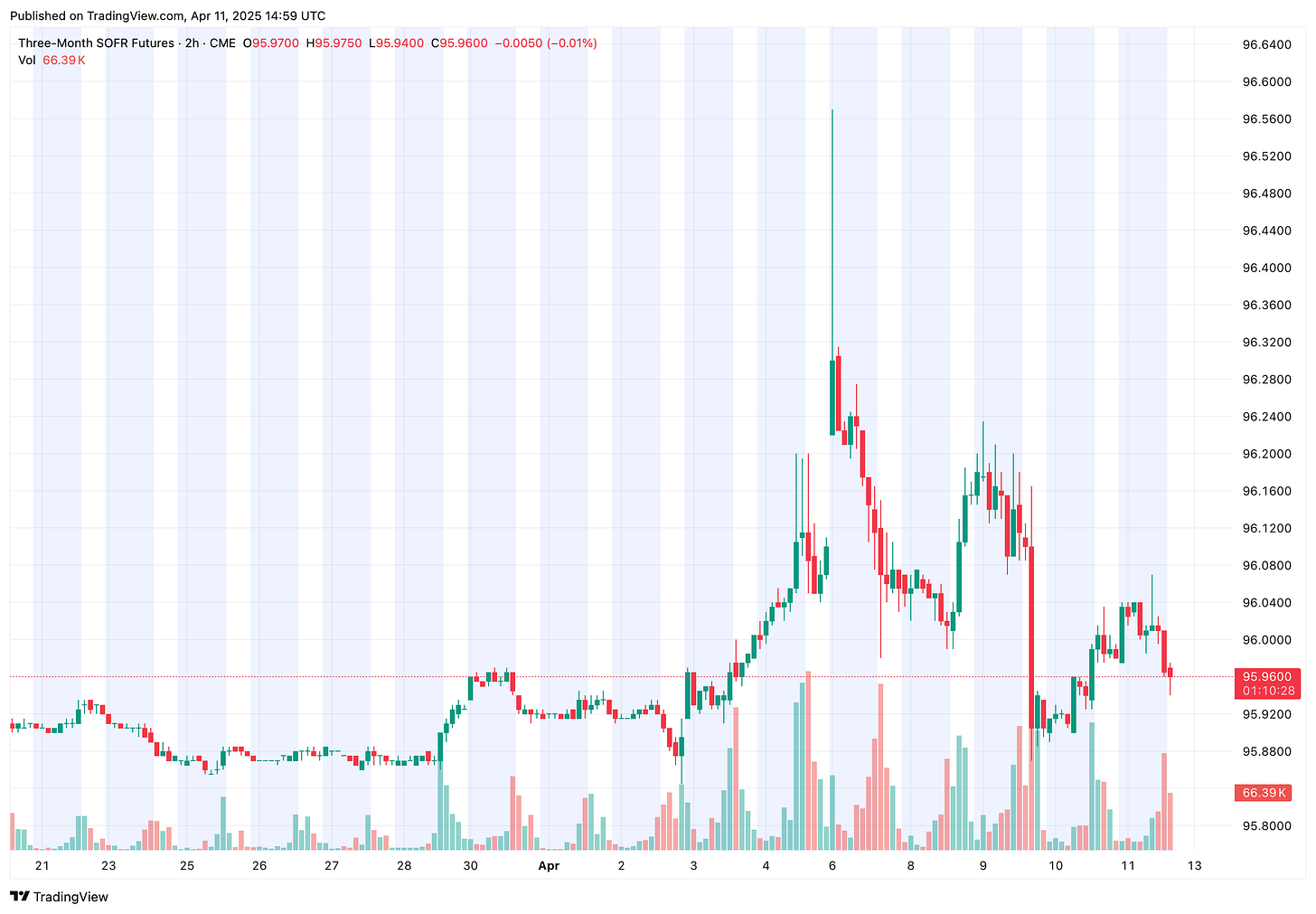

Here are SOFR futures. This is a three-month interest rate product. Short term. It’s basically interest paid by banks on USD deposited outside of the United States. Mortgage rates are set via this market. The tick value is $12.5 per tick, so the move from 96.66 (the high on Sunday April 6) to the low on Wednesday after the face ripping stock rally of 95.87 is almost 1 full basis point. Remember, traders and banks have thousands of contracts on, not just one. Again, not nearly as volatile as longer-dated treasury notes/bonds. (If we were trading on the floor, we’d be absolutely crushing it right now)

Who would possibly join with China to push up the rate of interest? The EU, Canada, Mexico. Who else? The problem is, do you want to partner with the Chinese long-term? They will screw you over and everyone knows it. It’s not a partnership.

I don’t think anyone knows what will happen.

Hence, sell stocks (uncertainty), sell bonds, and buy gold. Don’t buy silver….never buy silver…..

(The Fox News commercials are wrong)

Market is NEWS DRIVEN not DATA driven

Great post, and a great explainer. Thank you!

Looks like "The Basis Trade" (this time) is really an uberhedged, multilegged "Relative Value" spread (might be ratioed, still sifting...). EU vs US. Seems to be the successor, London based, trade that blew up under Truss from Carney's New Rules at the BoE. (Yes, THAT Carney.*)

More on it, and ZH has been trying to keep up on this outsized whale of a trade that a LOT of people piled into, on the erroneous assumptions of "He won't tariff!" and "They'll just have to keep issuing!", and lastly "JPow will have to cut!".

More here, and this is a very complex trade, plus optioning off of it, for the ATM factor: https://traderscommunity.com/portable-alpha-is-the-basis-and-carry-trade-sustainable/

Side note: Spread between GLD and physical showing a LOT of stress, IMo

Now where'd I put my helmet....and this is EXACTLY what the floors handled, lived for actually, in guts and sweat.

*If you want to see just how munificent Canadian "PM" Mike Carney is, look no further than the politically connected "deals" landed by his Brookfield Asset Management.