Inflation, A Solution

Lots of Factors Affect Prices

A while ago, I blogged that inflation might in fact be transitory. The reasoning behind that is the whole entire worldwide economy was shut down for Covid. That created lots of dislocations in supply chains.

The bullwhip effect is powerful when it comes to supply chains.

On social media, I have seen a lot of people point out the problems of inflation. We have problems at ports. It’s not just in Long Beach, California. The port in Savannah, GA is messed up too. We have empty shelves in supermarkets and home supply stores.

I am doing a home rehab right now. Fun times!

I purchased appliances last February, and some still are not in. The range we purchased has gone up in price 35% in the ensuing months. It’s not just big-ticket items like that. The classic inflation example is a loaf of bread. The price of bread is up. A loaf of bread at $2.50 in 2019, climbed to $3.00 in 2020. That price jumped again to $3.75 this year (2021). That is a price jump of 50%.

Of course, everybody and their sister and brother know gasoline has skyrocketed in price. Routinely, people are paying $70 to $100 a stop to fill up their cars. That is President Biden’s fault because he totally revamped energy policy which was pretty good during the four years of Trump. Turns out decreasing supply has an effect on price. Maybe there is something to this trickle-down thing everybody rails against? (More on that later in this post)

For sure, fiscal policy has played a role. With a government that is spending with no limits or constraints, the fiat currency goes down in value. It’s important to remember the multiplier effect on GDP is very close to 0 when it comes to government spending. For those that don’t believe me, every dollar spent has to come from somewhere. When the Federal Reserve creates those dollars, it’s just a tax on the future income of all Americans. They don’t get created out of thin air. If you’d like some academic computational analysis, see Professor John Cochrane’s blog. He has several inflation blog posts here.

For those of us that lived through President Carter’s years in the White House, we remember stagflation. It was horrible. I took my student loan money, borrowed at 3%, and reinvested it in the money market at 21%. That’s how screwed up things were. Today’s money market rates are close to 0%.

Again, it is easy to point out the problem. Politicians point fingers and shout off their soapbox all the time. It’s rare they use their megaphone to offer real solutions to help people. Mostly, they just try and create more reasons for them to exist, which means increasing their personal power.

It’s also easy to blame the Federal Reserve for increasing the money supply and for keeping interest rates low, but that isn’t the only factor. The Fed has put their pedal to the metal in unprecedented ways since 2007, and we only now are getting real inflation.

It’s also easy to say, “let the supply chain heal itself”. But, that doesn’t provide any comfort to anyone today. It will take years for the supply chain to sort itself out given the fact there is a new disincentive for American businesses to manufacture in China. The disincentive isn’t price-related, it is government policy-related as the Chinese government cracks down on all liberty-minded and free-market things. During the Carter years and prior, no one was doing a lot of manufacturing behind the Iron Curtain.

Of course, the Biden Administration consistently talks about raising taxes and penalizing success, so companies that might try and build stuff in the United States to heal the supply chain don’t until the incentives to do so get better.

So what should we be doing?

It’s helpful to look at extremes when thinking about this. Extremes would be polar opposites, like monopoly vs perfect competition.

There is one truism in economics no matter if you are a Keynesian or a Classical economist. Intense competition drives down prices.

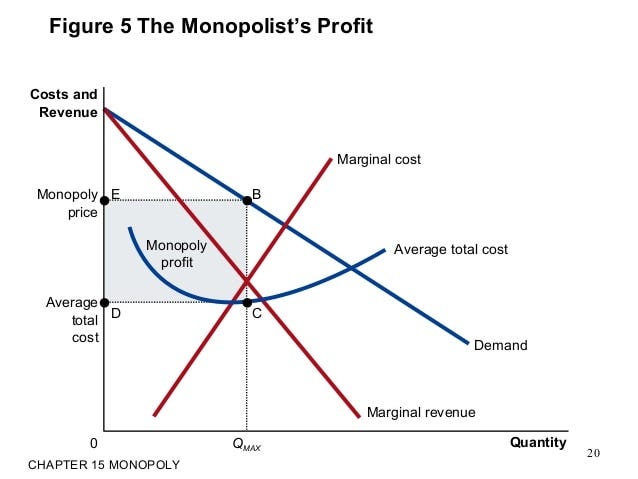

However, there is a caveat. To drive the price down aggressively, you can’t have monopoly or monopsony. Monopolists will drop prices when confronted with competition, but only to the point where they will bankrupt their competitors. A good monopolist will produce were the marginal cost of the item equals the marginal profit (MC=MP) which tells competitors to stay away. In the chart below, it’s denoted by Q(max) on the bottom axis.

Let’s look at the same situation with perfect competition. Perfect competition means anyone can enter and compete, and exit is easy too.

Notice the difference? The marginal revenue is equal to the demand curve. The demand curve is perfectly horizontal. Look at the demand curve the monopolist faces, it has slope.

How does that inform our inflation discussion?

Well, we assume that businesses aren’t a charity and they are in it to make a profit. Hence, they will produce where MC=MR.

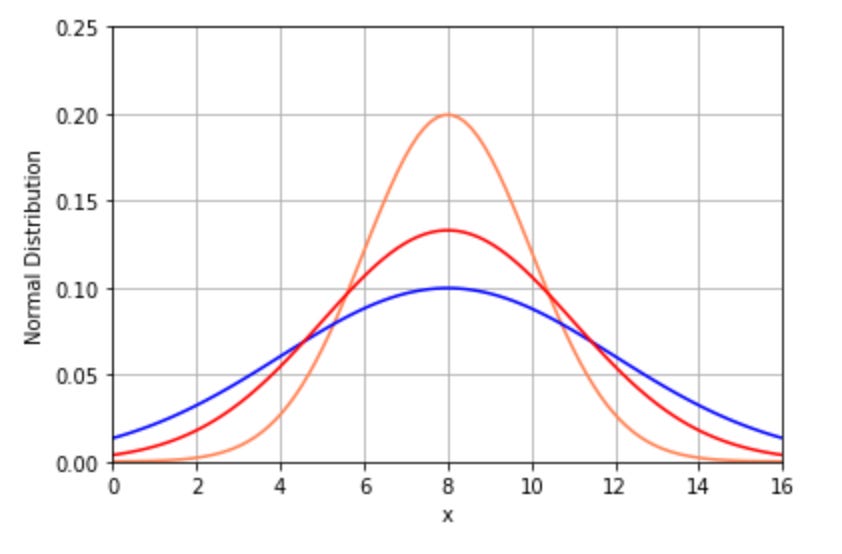

Keynesians love to look at demand curves. But, demand curves are highly variable in general. Even with things like gasoline. Prices go up, people will drive less. The key with demand curves is they are highly unpredictable. There is a lot of variance in them. Variance in statistics is the measure of the spread of the normal distribution. If the spread is tight, less variance. See these three distributions. The orange line has less randomness and variance than the other two lines.

That’s why trickle-down economics is important and why people who deride it using stupid soundbite economics clearly don’t understand the first thing about economics. It’s not about money trickling down. It’s about the supply line.

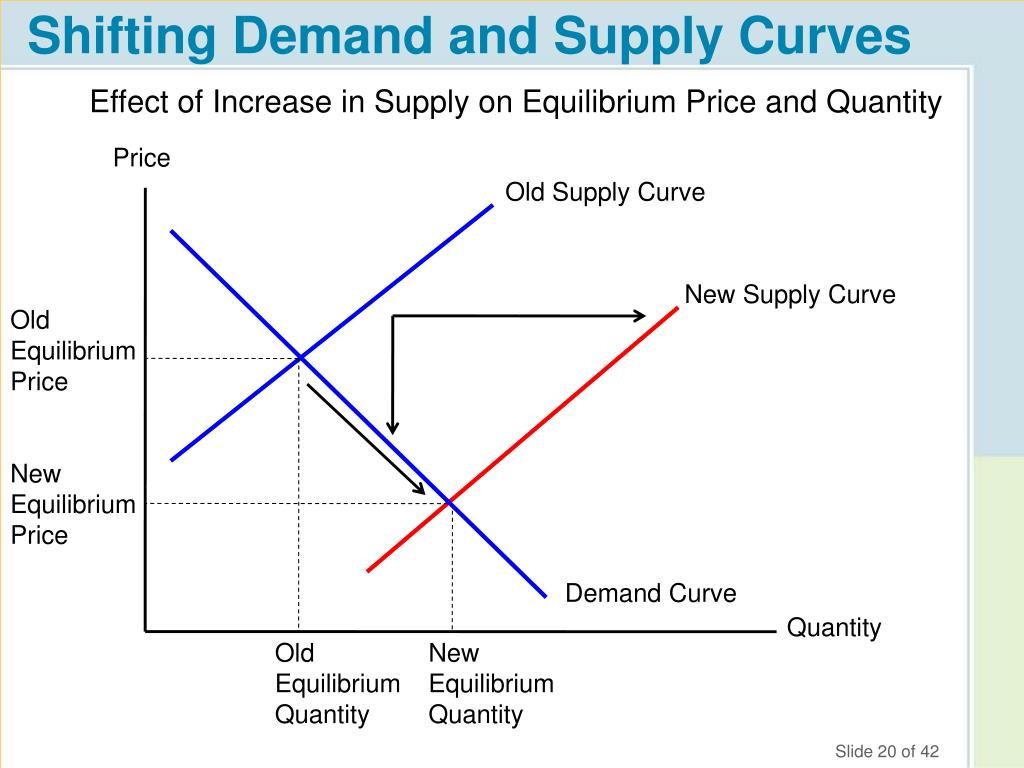

When we increase the supply of goods or services with constant demand, what happens to price? It decreases. If we go to our bread example, the more bread there is the cheaper the price.

We can look at all the inputs of the supply chain and we can measure their randomness. We can be “more certain”. That means less of a bullwhip effect. When governments shut down the worldwide economy, they totally screwed with the price system that governs supply chains. They took the orange curve above and turned it on its ear into the blue one. This two-minute Milton Friedman video explains how the price system affects supply.

This is also why centralized government setting prices will always do worse than a free market price system.

Now, let’s take this one step further.

Our goal is to whip inflation. We have proven above that if we try to get to perfect competition, we know that prices will come down.

President Gerald Ford took over for President Nixon and didn’t whip inflation. President Carter made it a lot worse. President Reagan beat inflation. Why? What did he do? Democrats derided it as “trickle-down economics” but it was really about supply.

What are the things we can do to move the supply line so there is more supply of goods and services?

A lot of it comes down to political policies. Here are some examples:

right to work regulations which put constraints on the supply of labor increases the cost of labor

regulations on certain businesses which put constraints on who can be in the business or who can’t. Obviously, some of those regulations are beneficial because they protect people or the environment, but the government can be too intrusive. The case where Obama highly regulated water where puddles in farmer’s fields is a good example.

Duties and tariffs constrain competition for goods. For example, the sugar industry is rife with duties and tariffs that restrain competition allowing domestic sugar companies to charge more for sugar than the market would otherwise bear.

Subsidies. Government subsidies cause market distortion. An example of this is the cost of attending college. Lots of subsidies increase the demand for college, but there is a static supply line of accredited schools to attend. By the way, the regulatory hurdles of getting accredited through the US Dept of Education further constrain supply. See the second bullet point.

The answer to some of our inflation and supply chain problems is simply changing political policies. A large percentage of those policies don’t keep us safer. But, they do constrict competition so that monopoly or monopsony ensues.

How many banks do we have? Guess what, if Treasury Secretary Janet Yellen’s hair-brained idea of tracking every transaction down to $600 happens, we will have even less of them.

How many health insurance companies do we have in America? Why is that? It’s because state and federal regulations make it difficult to start new companies due to all the constraints on the coverage they offer combined with government-run health care for poor people and old people. Not to mention the fact that terrible wage policy in the 1930s by FDR created the incentive to tie employment to health insurance. Democrats’ answer to this is socialized medicine where everyone will get less and pay more for it. The right answer is to free the market up so it is highly competitive and everyone will get more care at cheaper prices.

How many oil companies do we have? Guess what, when you limit fracking, energy exploration, distribution, and tax the end product vociferously, you have less of them and you wind up with less energy which increases the price to everyone.

Yesterday, Democratic Minnesota Attorney General Keith Ellison was crying about the price of beef and openly wondered about meatpacker IBP, which has a lot of plants in Minnesota. If you look at the meatpacking and slaughterhouse business, it’s highly concentrated. It’s enormously hard to build and start competing slaughterhouses. It’s virtually impossible to decentralize meat slaughter through traveling abattoirs, not to mention that doing decentralized slaughter doesn’t seem to scale cost-wise either. Yet, I bet dollars to donuts that AG Ellison doesn’t have deregulation on his mind with his rant. My guess is he wants to centrally set the price meatpackers can charge, ignoring the costs and opportunity costs. His solution would cause more beef producers to go out of business and create a lower supply of meat.

Do you know what that would bring us? Less meat at higher costs.

We can cite industry after industry that has this phenomenon. America used to embrace competition. Now, with the “everyone gets a trophy” attitude of policymakers and regulators we have created a place where industries are concentrated.

Trickle-down economics was never about money or who gets what. Trickle-down economics is about supply curves. Part of the solution to our inflation problems in fact is trickle-down economics because trickle-down concentrates on the supply of goods and services, not the demand for them.

Brilliant blog post. Well played and thank you. I think I earned at least 2 credit hours.

JLM

www.themusingsofthebigredcar.com

"Part of the solution to our inflation problems in fact is trickle-down economics because trickle-down concentrates on the supply of goods and services, not the demand for them." So the problem is trickle-down economy! I don't see how you could control demand for goods and services, maybe by order from government, ha, ha.