If I told you that I would fund your trading account if you jumped off a bridge and landed in a river, would you do it? I have a friend that actually did this by the way.

You can’t see the bottom. You don’t know exactly how deep it is. You might not know if the water is clean or not. But, if you wanted to trade, would you take the risk? How about going over Niagra Falls?

One is clearly more risky than the other.

I was thinking about this when I read this tweet.

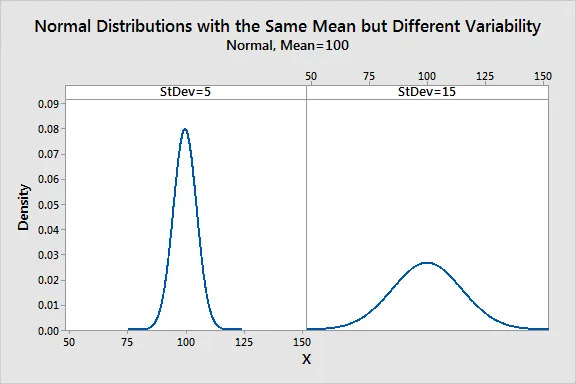

First, what is volatility? I think this tweet gets it wrong. Volatility is the measure of the spread underneath some probability distribution. Volatility is really “variance”. Sigma squared in statistical terms.

Here is a visual representation using normal distributions. Tight distribution, low volatility. Wide distribution, more volatility. More volatility simply means more risk.

But, just because something is volatile doesn’t mean that you can earn outsize return.

Some assets can earn an outsize return but it’s often hard to know which ones. Investing in some assets can be binary, gain or total loss.

I do find from experience that if you invest in something everyone else thinks is great and also sees means your return will be smaller. If you want to invest and get outsize return, you will have to invest where the crowd doesn’t see it. Be that bull that faces the herd and doesn’t run with it.

For Bitcoin, you were that person five to ten years ago. The herd knows about crypto and Bitcoin now. They might not understand it. They might not believe in it. But, they know about it. Bitcoin returns could still be great, but should be less than they were.

It’s like investing in startups. Who makes the most money? Data shows that the investments in seed-stage do better. However, they take extreme risks and often fail. Ideas at that stage look stupid. The herd doesn’t see it. The entrepreneurs are often unproven. Investing later in the cycle can make you money but you are assuming less risk.

I think that people really don’t understand risk, how to quantify it, or how to manage it. Sometimes you have to accept it and you can’t do a thing about it. That’s what happens to me when I invest in a startup. I feel confident about my investment because of the background research I did to make it. I feel confident based on other factors and my own experience. But, once the money is wired I have very little determination on what the outcome will be. Even if I have a great network and can put the entrepreneur in the batter's box to take a swing, I can’t take the swing. I also can’t really hedge the risk I took. My only action is binary, take money off the table or not. If you take money off the table in seed-stage investing and you do it too soon, you will wind up not making money over the long haul.

To make money, you need to do the research. You need to do a lot of homework and look at things objectively. Of course, the more research you do the more able you will be to figure things out quickly and assume more risk. Doing the work creates a virtuous circle for yourself.

Even when you do the work, you might lose.

Knowing where you are emotionally also makes a big difference. I know people that just quit trading when they were going through traumatic life events like divorce. You might not be in a good emotional place to take risk. Once I wanted to invest in a startup. We were going through a really hard time. My wife wasn’t emotionally ready to assume more risk on startups. We had invested in a bunch of them, and financially we were hitting what was the bottom, but we didn’t know it was bottom until we were looking at that time in the rearview mirror years later. You have to understand that and never look back on decisions you made or didn’t make once you make them.

Time horizon makes a huge difference in perspective too. When I traded on the floor, I might have a time horizon of seconds. Investing in my retirement, I had a time horizon of how many years it was for me to turn 59.5. I took some risks at age 30 that I wouldn’t take today. Now that I am 59.5, I have to figure out how to manage it to support my life, and have enough to live out the rest of my life. That means my risk preferences will change.

Investing in things that are not exactly correlated to each other helps with managing risk and diversification. If I invest in cryptocurrency, it’s highly likely that there is a high correlation between various cryptos. Bitcoin, Ethereum and the others move together as a herd. It’s counterintuitive, but diversification and non-correlation actually help you assume more risk.

How much money you have also makes a huge difference in your risk preferences. If you have a steady gig, steady income, can cover your monthly costs, you can assume a little more risk than someone who doesn’t.

When it comes to crypto, there are a lot of risks that get unaccounted for in any strategy. The largest is regulatory risk. As Northwestern Professor of Law John McGinnis said in a panel we were on together, “Will the State objectively regulate cryptocurrencies when cryptocurrency has the ability to topple one of the State’s greatest powers, money creation?”

I don’t think you can quantify the regulatory risk, but you must pay attention to it. America isn’t China yet but a lot of the people in government sure act like it is China. As you look around the world, you see similar tones and attitudes.

I also think that adjacent competitors can enter the crypto space and dislodge early companies. This is especially true when it comes to traditional finance like prime brokerage and other functions. I don’t think customer loyalty is a huge thing in these areas. It’s all about liquidity, fees and network effects.

There is a lot of binary risk in crypto. It’s going to work, or it isn’t. If it doesn’t, what is the residual value of the underlying asset? Probably not much.

Most of the returns in crypto have been fueled by speculatory fervor and not actual products. Hand in hand with the fervor is the actions by the Federal Reserve since 2008 that have caused people to reassess their risk/reward preferences. Cheap money and no interest rate earned for holding money will do that.

There also is a lot of fear of missing out happening in investing circles today. Traditionally, the long-term return of the S+P is roughly 8-9%. We have seen outsize returns since 2009. Venture returns have been outsize in the last five to six years. Endowments are restructuring their asset allocations to try and capture those returns in the future. Of course, see my point about the herd. The more money that pours into an asset class the harder it is to generate outsize returns. Things tend to drift back to the mean.

Additionally, a lot of the crypto world is building things that seem absolutely nuts. I have pointed to Filecoin and Helium in the past and I own both of them. Would you buy them at this point? What are other projects that seem to be nuts but would be sort of cool if they really worked?

I just lost a bunch of value in the Helium tokens I own in this crypto crash. I am not worried about the short-term volatility. I am betting that Helium can bring a viable competitor to existing telecom companies. That’s not going to happen tomorrow. It’s more likely to happen five to ten years from now.

Investing in an index probably won’t give you outsize returns. There are fees, and indexes are diversified. They capture some of the return, but not all of it. In traditional assets, they are a way to manage risk. In crypto, I am not sold on the fact that they are a diversified way to manage risk.

I am reminded of startups. Investing in different startup sectors doesn’t give your portfolio diversification. Each startup you invest in just adds to the total risk of the portfolio.

In some cases, funds are the way to go. I invested in Typhon because I don’t have the time, nor do I have the expertise at this point to do what they are doing in crypto.

If you want to build wealth and generate market-beating returns, you need to be willing to assume the right amount of risk that fits with your personality and your financial condition at the time. A platform like Riskalyze can help guide you with that.

As always, this old advertisement from the Chicago Mercantile Exchange always holds true.

Brilliant commentary as always. Well played. Hitting all the high notes.

1. Is a tight distribution low or high volatility?

2. You can mitigate risk by knowing about operating the underlying industry. I once bought a 16% preferred bond from a REIT because I knew the company backwards and forwards and that the preferreds were mortgage backed.

The rate was so high because it was a tiny issuance and could not attract or absorb corporate attention.

3. As to asset class, there are some powerful mitigations in real estate as an example. Within real estate there are sub-classes -- apartments as an example -- that have a known response to changing economic conditions -- talking to you, inflation.

4. One of the problems with crypto is the basic issue of is it a trade or an investment? Nothing wrong with either one.

This is why something like Coinbase -- picks/shovels/overalls to crypto -- is such a brilliant play.

5. Lastly, a lot of the interest in crypto is simply because it is easier to buy/sell/own from a pure infrastructure perspective. It is paddling into the mainstream which means its regulatory day of reckoning is on the horizon.

No nation/state is going to allow a financial instrument that creates anonymity, funds crime, crosses boundaries, and can be used to cheat on taxes.

Keep it up and Merry Christmas.

JLM

www.themusingsofthebigredcar.com

Sorry, wrong link below Jeff. Here is the correct link: https://asiatimes.com/2021/12/quantum-hackers-can-bring-down-bitcoin-expert/?fbclid=IwAR0TgwbQc1JcCaW-gFgI0ckJzNg6v6wI5S_FkZ--ECl0CVt_LSpVc-w6iNA