You can’t educate someone about inflation any better than this video does. Please show it to anyone born after 1980. Those of us that lived through the 1970s remember the effects of inflation really well.

Right now, some union workers are going on strike for higher wages and one reason is inflation. Their current salary doesn’t go as far as it used to. We are in the “prices are going higher” phase of the inflationary spiral.

Since wages don’t adjust right away, workers are realizing they need to try and catch up. They can’t and if they do, they will be taxed higher simply because the tax rate won’t change and the higher wages will push them into a higher tax bracket.

To help you understand who Bob Crawford might be today I calculated the difference between 1978 dollars and 2022 dollars. The example in the video shows Bob Crawford making $18k per year in 1978. Today, that would be $81.3K.

Government spending causes inflation, period.

The government prints the money. It’s not the gas station owner, the oil company, the farmer, the food processor, or anything like that. It’s the government period and The Biden Administration has no respect for the value of capital.

I saw Josh Brown talking about how commodity prices are going lower. That’s because a slowing economy creates demand destruction. I know in the meat business, farmers are significantly reducing the amount of livestock they raise which in turn is leading to some lower meat prices right now. But, what happens a few months from now when there is a smaller supply of meat? Demand destruction is a poor way to cure inflation.

Why?

Because it is painful for people. It’s super painful on the middle class and poor people. Rich people can afford to pay, and lower prices work in their favor since it becomes cheaper to purchase assets. Upper-middle-class people can alter their lifestyles just a little bit to avoid a lot of the pain. However, that is the path the Biden Administration has chosen.

The best way to cure inflation is the way I illustrated.

Cut government spending.

No new programs.

Cut capital gains and corporate taxes to 0% so there is an incentive to invest.

That’s working on the supply side of the inflation problem. It creates an opportunity for people, not punishment.

It seems that the more progressive your politics are, the more you focus on demand when it comes to economics. Liberals seem to like economic punishment rather than opportunities. Centralized plans and government programs limit opportunity rather than create it. It’s the antithesis of free-market economics.

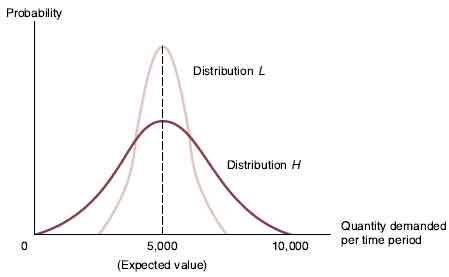

To put it in economical statistical terms, demand is random. The demand curve in the supply/demand economic equation is much much harder to predict and control. The supply curve is less random and there are many levers to tighten the randomness around the supply curve. We are “more sure” about what is going to happen.

Here is a photo of what I mean. The distribution that is flatter and wider (H) is more random. We aren’t as sure which is shown by the lower probability on the left axis. There is more “volatility” in it.

It turns out that increasing the supply curve of opportunity to cure inflation is much better than the destruction of demand.

I think we all intuitively understand what has happened (at least the readers here). By doing lockdowns and creating an enormous climate of fear, the government destroyed a big portion of the supply curve.

Then, they attempted to solve the problem by WAY overstimulating the demand side, which actually created even more supply side destruction.

What? My theory is that many people received a lot of money from the government at all levels such that they no longer needed to be employed, nor to even work as hard to produce a product. For example, I know of many people who just chose to stay at home and do occasional side gigs rather than go back to work, because unemployment was "no questions asked." For a long time, the federal government was subsidizing state unemployment. I had prospective employees making more on the government dole than I could pay them. When there was no one available, I ended up just paying a lot more. This cycle continues today.

What people also don't realize is that all wages will eventually come back to equilibrium relative to each other. I always shake my head at these "$15 minimum wage" movements, because they never work. The chef will always want to make X times his rookie cook. The senior police detective will always want to make more than the rookie patrolman, and by a certain amount. The attorney will not condone making less than 5X what a paralegal makes (or whatever), or, what their doctor makes. Everyone thinks relatively, which is why inflation will always be a danger. Because labor is often the largest input into any product, inflation is always subject to whatever wage rates are doing.

Kudos to Milton Friedman for his ability to explain this (and to you, Mr. Carter) simply. It is a hard subject to truly grasp for non-economics people. Friedman reminds me a bit of Thomas Sowell.

The video is great. You missed your calling as an economics professor :)