The psychology of the stock market has turned but a lot of people haven’t figured it out yet. We had a long long bull market with some mini-corrections. Covid changed that.

The steep drop of the market when Covid hit in February 2020 saw an unprecedented recovery. Happy days are here again right?

I turned on the television this morning and saw Jeremy Grantham talking about a superbubble and a massive break in the market. Bless his heart. He’s been talking about a market crash since around 1988 I think.

Information dissemination happens faster and more efficiently than ever and that affects markets.

I do think that the cheap money policies pursued by governments all over the globe were disconnected from the economy. That’s created some bubbles, but it is awfully hard to sniff them out ahead of time. You might say there is a “housing bubble” except what seems to be happening is people are relocating and demand outstrips local supply.

There are speculative bubbles. If you look at cryptocurrency, it’s easy to say those markets are in a speculative bubble because so many people think the whole concept is the new tulip bulb. Maybe what really is happening is that people who never had access to risky assets are plowing money into things that they think will pay big dividends in the future. For sure, cheap Fed money has changed risk preferences but speculation by itself is not a bug, it’s a feature. Pre-crypto, you had to be an accredited investor to get into the early stage stuff. You also needed to have developed a good network with good deal flow to make money. If you didn’t have that you couldn’t play because even if you were investing in stocks on Wall Street the big pop happened before the stock was listed.

The disruption in supply chains combined with the absolutely backward fiscal policy coming from governments across the globe created an environment ripe for inflation. This blog has some excellent posts on the phenomena.

Helicoptering money to people never works. That’s what the government did.

We see world events changing psychology. A potential war in Ukraine is just one of them. Seeing the fascist actions by Trudeau in Canada isn’t helping. The Olympics being in China has kept their totalitarian brutal regime in the minds of people.

Then there is the President of the United States. He appears weak. His voice is weak. He walks weakly. He doesn’t inspire confidence. He isn’t big enough to fill the position like his predecessors. His speech Friday sounded like a corporate executive trying to manage a corporate crisis. He didn’t sound inspiring.

When he speaks, he just recites lists. Let’s Go Brandon!

Republicans are longing for a return to Trump but he is not the answer. The reason they are thinking that way is it is convenient and recent. Trump also does a good job of staying in the limelight. Trump knows how to speak to and appeal to a wide variety of people.

Inflation is not transitory. It’s here. It’s not going away. When we had inflation in the 1970s, our national debt was roughly one-fifth of what it is today. The other problem is the solution to the inflation problem isn’t just an obviously late knee-jerk reaction of raising interest rates.

The economy is not a puppet. It’s a river.

When the Fed raises rates, that debt is going to get a lot more expensive to pay. This is a shadow tax on your wealth, your kids’ wealth, and your future descendants’ wealth. When we were doing our rehab, we saw the costs of things skyrocket. Virtually everything and people in the know told us the price won’t go down ever again. It might stabilize, might go up, but it’s not going down. Faucets are not gasoline.

Speaking of gasoline, because of Biden’s policy on energy, gas prices are significantly higher. In my state of Nevada, it’s $4/gallon. Here is where you see a real divide in America. The global warming advocates see this as a feature, not a bug. I saw a local news anchor glowingly comment on the fact more electric cars were being bought. Of course, if those cars are getting their charges from coal-fired power plants, it really doesn’t help global warming, does it? Just a thought, the mining of raw materials needed to build batteries for electric cars isn’t “clean” either.

There is no free lunch and opportunity costs are everywhere.

There also are two conversations happening simultaneously in America. We aren’t united. That is undermining markets. Being long stock in 1858 and 1859 didn’t work. For those that took history recently, the Civil War started in 1860. Just look at the coverage over the Durham release on Hillary Clinton’s campaign. How is your news channel reporting it, if at all?

We are not at an inflection point in our cold Civil War yet. Just steady escalation. I don’t know where Mrs. O’ Leary’s cow is but it could be out there.

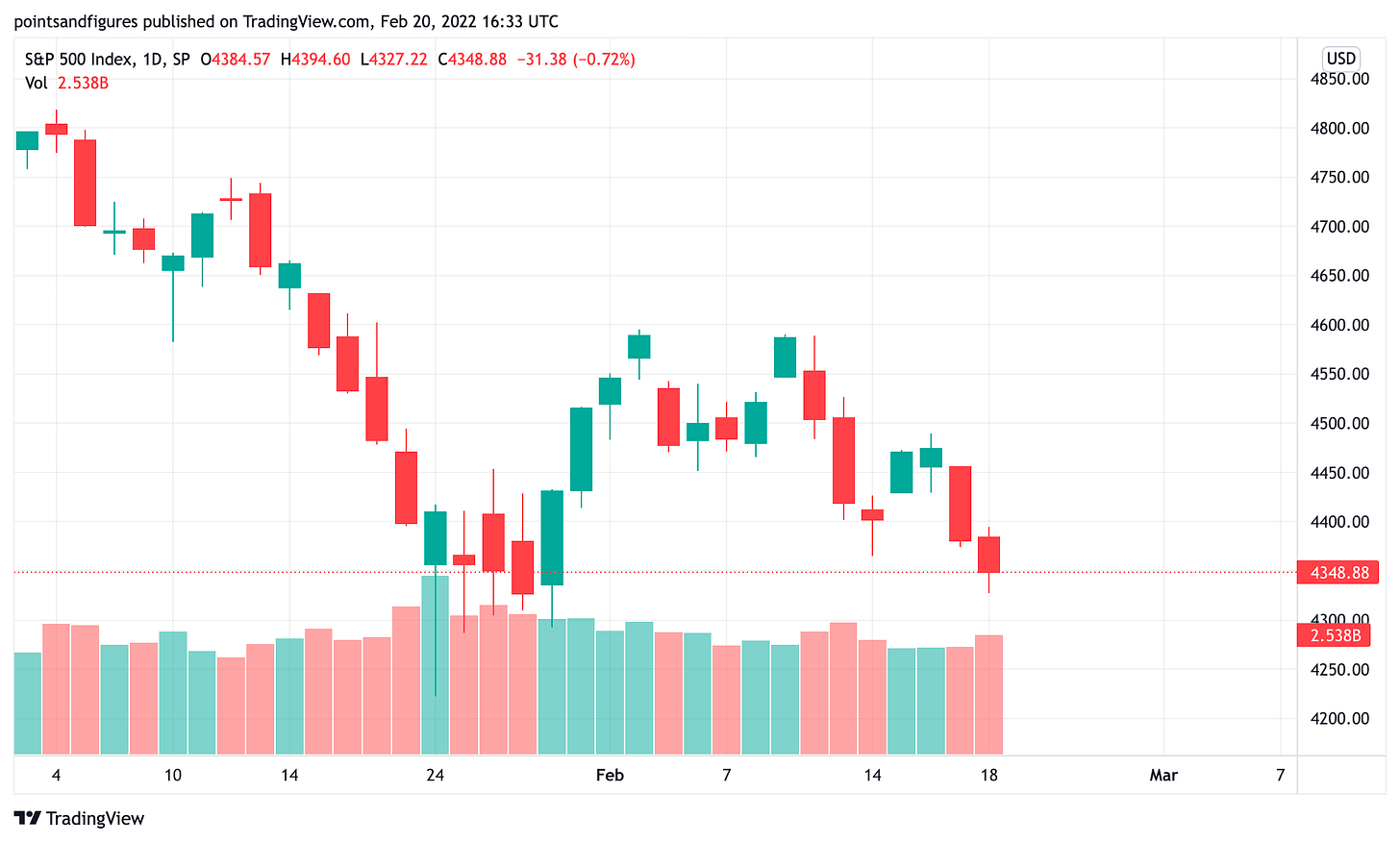

The title of this blog post is STFR. The mantra in the market over the last several years has been BTFD. Selling the rips in the market are the way to go right now. You didn’t get hurt buying the dip in the past, but you will now.

How do you know?

Go ahead and put on a short position when the market has a rallying point. You will feel some pain as buyers emerge. But, I bet in a reasonable amount of time, your short position will easily be able to be scratched, or make you money. When I was trading, that’s how I knew psychology was changing ahead of other people. If I got my longs back in a break, or my shorts back in a rally, you knew that people were trapped.

By the way crypto companies, it would be nice to be able to enter price orders and stops on a retail platform.

If you own a lot of indexes like I do, there are only two choices. Sell or take the pain. You can’t pick tops or bottoms, but in a bear, you know that you will be able to buy them back cheaper.

This is not a bullish chart if you are into that sort of thing.

Jeff, 3 weeks later and Russia/Ukraine in the mix, you still feel STFR is appropriate? Obviously individuals circumstances and needs vary, but in general are you still feeling the same? Thx.

1861, April. You should be more precise and careful. But I do love your blog.

Going to start my own. Thinking of calling it "How Shall We Then Live" in tribute to the great Francis Schaeffer.

His film series of the same name had a HUGE influence on my life and how I viewed the world.