The Fed Eases

Cut Rates .25, but That's Not All!

Today, the stubborn Fed cut rates .25. That was expected. There was far bigger news. The Federal Reserve said it was going to expand its balance sheet.

Chicago Fed governor Austan Goolsbee voted to hold rates steady. Why? Number one, he is a Democratic operative. He will do anything to undermine Republicans. Second, he is a Keynesian, not a free-market freshwater economist. He was one of Obama’s economic advisors. He follows Krugman and Stiglitz, not Milton Friedman.

Here is the meat:

Inflation is seen falling to 2.5% in 2026, compared with 2.6% previously projected, and a level of 3% to end 2025. GDP is seen rising 2.3% next year versus 1.8% previously, while GDP for this year was revised up a tenth of a percent to 1.7%. The unemployment rate is seen ticking down to 4.4% next year from 4.5% this year, the same as seen previously. The unemployment rate currently stands at 4.4%.

Officials will also resume purchases of short-term Treasurys as needed to maintain ample reserves for the banking sector and hold the balance sheet level.

I have been in the “cut rates“ camp for a while. As per usual, the Fed is behind the curve. The rate should be another .25 or more lower. It was the Fed playing politics and being anti-Trump that stopped them from cutting before.

But, despite every attempt by the left-wing news media and mouthpieces to try and fan the flames of inflation, it’s not there. That’s because of DOGE and other efforts to cut government spending. As we root out more and more fraud, the Somali thing in Minnesota is the tip of the iceberg; we will see government spending decrease more.

Inflation is a government spending problem, not an interest rate problem. I have written this before, but it bears repeating. The multiplier effect of government spending on GDP is zero, or very close to zero.

But, to me, the big news is the fact that the Fed is going to expand its balance sheet and buy short-term treasuries. Check out the action on the two-year note futures.

Those big green candles at the end of the chart reflect Fed sentiment. Buy Mortimer Buy. That means the interest rate on the shorter end of the yield curve will be coming down.

One part of the market that people don’t understand, nor see, is the interbank trading market. Banks swap securities with each other all the time. It’s called trading credit default swaps, or CDSs. When the interbank market is liquid, credit flows, and everyone is happy. When credit derivative spreads widen and there is illiquidity, everyone gets indigestion.

In 2008, the first cracks were seen in the credit default swaps market. Banks didn’t trust each other and couldn’t trade. The illiquidity caused a rush to get into cash, and that rush cascaded into ALL markets, not just stocks.

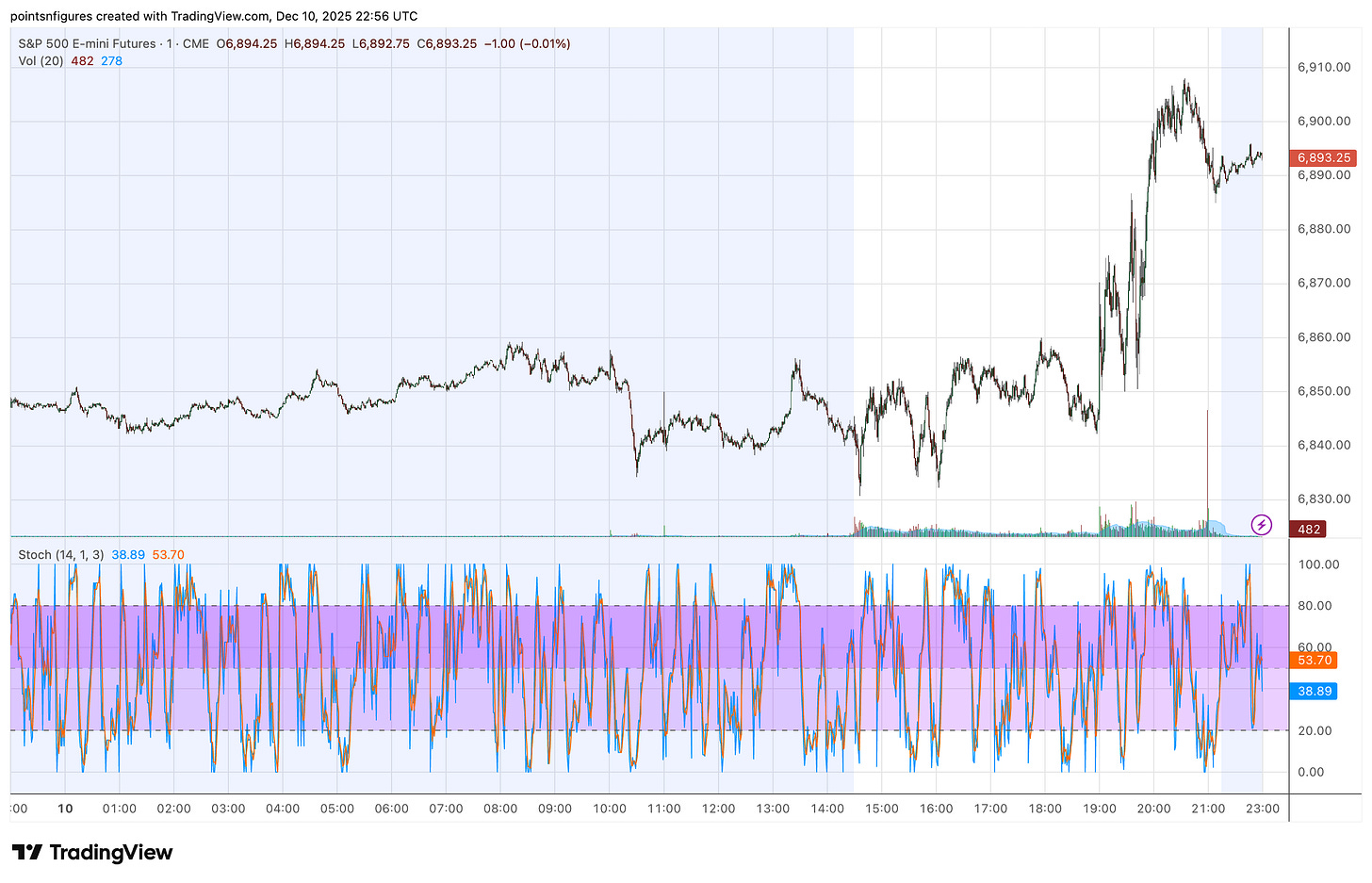

The “expand the balance sheet” combined with we see ‘inflation going down” is a big, huge deal to banks and brokerages. That’s what lit a fire under the stock market today. The market is bid, and will continue to be bid. This is a chart of today’s stock market futures action. I think you can see when the Fed meeting statement was released.

The permabulls aren’t going to be happy. Neither will the Democrats.

https://www.economicforces.xyz/p/price-theory-and-the-price-level?utm_source=post-email-title&publication_id=86578&post_id=181116682&utm_campaign=email-post-title&isFreemail=true&r=ixt4&triedRedirect=true&utm_medium=email Great discussion of price indexes, and inflation here

As a consequence, silver might be in the process of making its last gasp pop up.

Minor league stuff compared to the politicization of the Fed and the inane continued allegiance to pushing a political agenda by the bumbling bureaucrats still remaining who are spoiled leftovers from previous administrations. The continued tariff tariff tariff cries sound as ridiculous as Marcia Marcia Marcia on The Brady Bunch.

The FED should have cut a half point months ago.