Way way back in time when the Federal Reserve along with Congress decided to bail out the banks after the 2008 debacle, we started down a bad road fiscally and monetarily.

The interesting thing about the 2001 Nasdaq drop was that even though a lot of people lost a lot of money, it was concentrated in one part of the economy. Tech.

In 2008 since the drop centered on housing, it was not confined. Remember, despite liberal history books trying to create history counter to the facts, the financial crash of 2008 couldn’t have happened without the government backstop of Fannie Mae and Freddie Mac. Those organizations with their implicit government backing provided the foundation on which banks could build their house of cards.

That’s why I was a big fan of letting banks go bankrupt. Bankruptcy is an excellent disinfectant and there are reams of settled bankruptcy case law to back up the procedure of bankruptcy. If the investment banks on Wall Street would have went belly-up, we would have been far better off having than happen and going through the bankruptcy workouts along with the consequences of those workouts than what happened with government bailouts.

As a result, the Federal Reserve engaged in “Quantitative Easing”. This was money creation at a very rapid pace. The legislative branch with acquiescence from the Executive branch did its part and increased spending.

I digress to help frame this post. Government spending is a huge point of contention among Ph.D. economists by the way. The classical school doesn’t give a lot of oomph or a high priority to government spending creating economic activity. The Keynesian school does.

Because the dollar spent (never invested, the government cannot invest) is created from debt, it is a tax on the future earnings of Americans. Hence, Keynesians can never answer the question, “Where did you get that dollar?”, correctly.

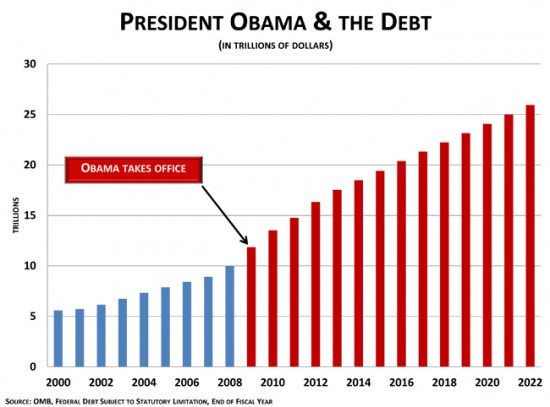

Increased rates of spending increase debt.

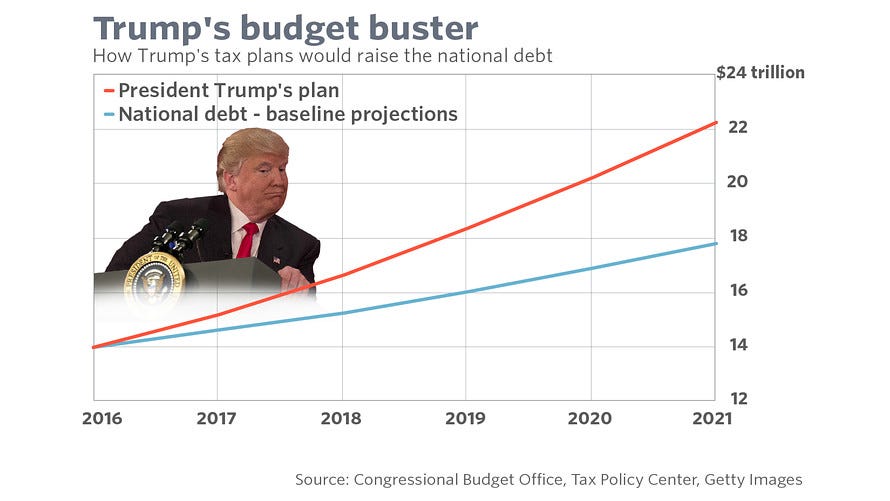

But, Trump was no miser either. You may like Trump for a lot of reasons but he never ever was serious about cutting spending and Congress was more than happy to oblige him.

Neither the Bushes nor Clinton before them were Presidents that were serious about actually cutting debt and reforming government spending so we had government do less and not more. Please don’t believe the government accounting hocus pocus dominocus, the debt has never gone down in my lifetime.

Government debt has always gone up every year for the past 60.

While the legislature and executive branch spent money like drunken sailors, the Federal Reserve added fuel to the fire by continuously using quantitative easing for almost the entirety of the Obama Presidency. That action made Obama look a lot better than he would have economically because GDP growth under Obama was anemic at best.

Quantitative easing caused incentives in markets to change drastically. Instead of buying muni or government debt where interest rates were close to 0%, investors chased returns in riskier assets. Hence, the stock market increased in value. Things like real estate increased in value. Risky assets like private companies and venture-backed companies increased in value. Cryptocurrencies emerged in 2008 as a result of the financial crisis and one of them, Bitcoin, garnered almost all of the consumer surplus in the market and rose to 68K in value before plummeting to 23K today.

Free money isn’t free and we are starting to find that out today. Bitcoin isn’t an inflation hedge. Fed tightening is hurting the value of risky illiquid assets.

Markets dropping show risk was mispriced wildly, and like air in a slow leak flat tire it is seeping out of the financial system.

The combination of poor policy laid kindling for a raging inflation fire if we weren’t careful. Then, Covid hit.

What did governments across the world do? They improperly shut down their economies and ramped up spending.

That totally messed up every supply chain. People were given free money and the stock market rallied, along with every other market. People spent that money on goods. There was zero paying interest in bank accounts so there was no incentive to save.

We are now at a breaking point. The thing that saved Trump during his Presidency were policies designed to grow the economy. The one good thing Trump did was move the supply lines for things like energy out which caused a drop in prices. That increased GDP which covered up the mess in the federal budget.

Biden’s spending went even higher once he was installed as President. Not only that, but he aggressively cut the things that underpin a lot of GDP growth.

With no GDP growth and super-high inflation, markets will crack. Our stock market is down big this year and it is just starting to get warmed up. Here is a year-to-date chart on the S+P 500. It’s down 2.5% today. The problem is that the people that are the brain trust for The Joe Biden Economy won’t ever change their course or direction.

If they did totally change course, there would be no economic miracle. There would be hardship, and not just a little. Government programs would have to be eliminated, not cut. Rates of spending would have to be decreased by not just a little. We would have to switch from a government-focused economy and government solving our problems to a private market-focused economy and the private sector solving our problems. But, eventually we’d find our way back.

The longer we delay, the worse it will be.

It is sad that the only way for fiscal discipline to occur is for something big to break. I'm watching it at the federal level, the state level (Illinois, for me) and some local levels (Cook County in my case).

It is a helpless feeling, because I know that my children and grandchildren are going to suffer because of this greed and recklessness.

The way the government behaves is the exact opposite of what every well-instructed person was taught growing up: a dollar saved is a dollar earned. Savings is a big deal, because it gives you freedom in the future. It gives you options when you need them. It makes you feel good that you don't owe someone your labor, and thus, your freedom.

As it is, we watch self-interested politicians in a ghastly game of hot potato continue to push the thing closer and closer to catastrophe. We all know it, but we collectively won't make the sacrifice.

As history tells us, this is the fundamental problem with democracy -- that we don't have the collective guts to do the right thing.

How are we going to fix this? Is the plan to just implode and then do The Great Reset?

Brilliant as always.

There is one point that requires constant repetition - the response to COVID was. as you note, shutting down economies and ballooning government spending.

The American problem is we never acknowledge this was temporary spending. The Biden Admin wants to continue to spend not just at that high rate, but at an accelerating rate.

There is no government financial restraint of any kind at a time we have to spend more on defense.

Well played.

JLM

www.themusingsofthebigredcar.com