Here is the employment situation. If you want to see a nice graph I couldn’t cut and paste into this post, here it is. The Democratic spinmeisters are excited. They are crowing about the ability of Bidenomics to juice the economy. Happy days are here again, aren’t they?

There is a problem though. If happy days are here again, why are economists saying we need rate cuts? You don’t cut rates in a strong economy because there is demand for money in order to build stuff. Mark Zandi, Keynesian, is loud and proud about cutting rates as are a lot of other Keyensians.

In other news from the above-linked article:

The Congressional Budget Office, an official US spending watchdog, said in May that the federal debt was set to reach 166 per cent of GDP by 2054.

More than half of the poll’s respondents said CBO’s debt estimate was credible, while more than a quarter said it was too low

The biggest areas of job gain:

Health care + social assistance 90.7K

Leisure + Hospitality 58K

Government 52K

Two of the categories are “government jobs”. Leisure and Hospitality is what it is and mostly hourly work, not careers.

The private sector isn’t growing. What a surprise. For years everyone who is a capitalist has said when government spending ramps up, there is less room for the private sector to grow.

Professional + business services 9K

Utilities 3.2K

Information 2K

Financial activities 1K

Mining + logging 0

Wholesale trade −1.2K

Manufacturing −4K

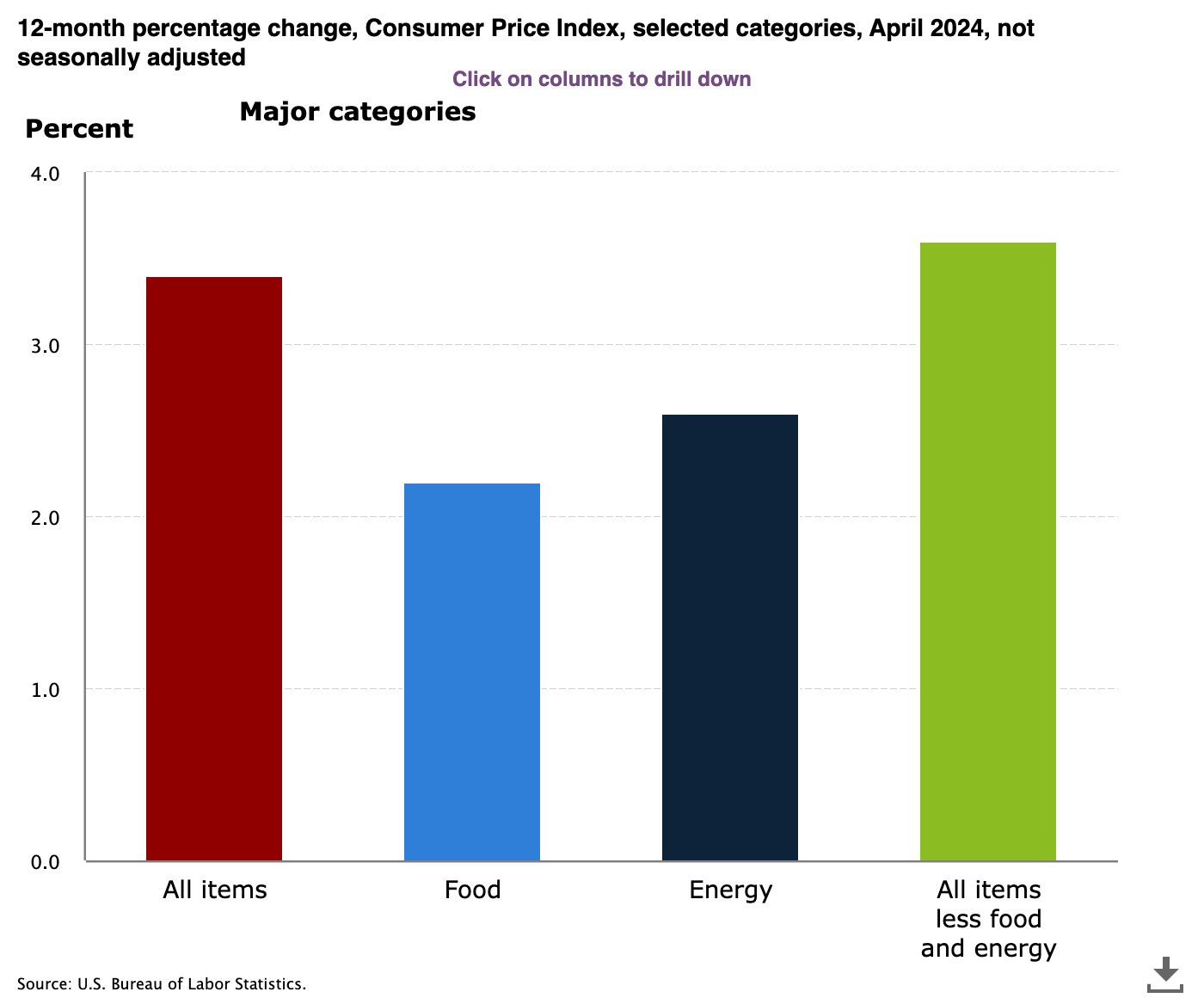

This is not a robust growth picture, which lends itself to the argument that we should cut rates. However, there is that pesky inflation problem. Cut rates, inflation is going to jump. Cutting rates devalues the dollar and with the way the Fed is spending and printing money, there will be a double whammy. Here is a chart from the BLS of CPI. Under 4% but still very high on a relative basis. Especially with GDP growth at 1.3%

Philosophically, the Keynesians put a lot of stock in the ability of government spending to grow the economy. The problem is, someone has to pay taxes to support the salaries the government pays workers. Or, you can issue debt which is a tax on their future earnings.

Hence, the multiplier effect of government spending on GDP is 0. Zero. Nada. If you look at it more stringently, it’s negative due to opportunity costs.

Right now, we are in a period of soft stagflation. Inflation with no job growth and no economic growth. Today, GM ($GM) announced a $6 billion stock buyback. Why? Because they are sitting on cash and don’t have any good place to invest it for growth.

I don’t think I’d be going long the S+P here but I don’t know that I’d be a massive short either. I’d fade rallies in interest rate futures.

In other news:

Primary day in Nevada today. I didn’t vote for Trump’s selection for Senate. He tepidly endorsed Sam Brown. I voted for Tony Grady and hope you do too. Tony is an Air Force Academy grad and former test pilot. Then, he worked in private industry for the rest of his career.

Sam’s a nice enough guy but there is no “there” there. I respect his undergraduate education at West Point and his service and I am empathetic that he was severely wounded. But, we don’t need a Tammy Duckworth on the right. I think the Mitch McConnell wing of the Republican Party also endorses Sam.

In our Congressional District Three race, I voted for Drew Johnson. He’s not a dynamic candidate. He’s a policy wonk. But, he understands what needs to be done to fix the fiscal crisis in Washington. Our district is gerrymandered to favor the Democrats. I don’t know the actual percentage, but I think it’s 4%. No matter who is running they have an uphill battle against that great trading machine Susie Lee. She is as prolific as Pelosi. Her husband is extremely wealthy. She can’t afford to lose the race because she needs the insider tips.

Let’s hope Trump has coattails in Nevada. Based on past performance, he has never had coattails like Reagan.

Zerohedge looked at the BLS report late last week.

https://www.zerohedge.com/markets/inside-most-ridiculous-jobs-report-years

The part I find most shocking is further down the page and discusses that <quote>not only has all job creation in the past 4 years has been exclusively for foreign-born workers, but there has been negative job-creation for native born workers since December 2019</quote>

@jeffreycarter I wonder how much of the healthcare+social assistance jobs that were created were funded by the government? A lot of new NGOs hiring people part-time and full-time with grants and other free government money. The government does not reflect our economy.