Unlike a lot of people, I don’t really care about the Theranos verdict. Too much drama. Here are the counts and the jury's verdict.

1. Conspiracy to commit wire fraud against Theranos investors: Guilty

2. Conspiracy to commit wire fraud against Theranos paying patients: Not guilty

3. Wire fraud against Theranos investors: wire transfer of $99,990 from Alan Jay Eisenman: No verdict

4. Wire fraud against Theranos investors: wire transfer of $5,349,900 from Black Diamond Ventures: No verdict

5. Wire fraud against Theranos investors: wire transfer of $4,875,000 from Hall Phoenix Inwood Ltd.: No verdict

6. Wire fraud against Theranos investors: wire transfer of $38,336,632 from PFM Healthcare Master Fund: Guilty

7. Wire fraud against Theranos investors: wire transfer of $99,999,984 from Lakeshore Capital Management LP: Guilty

8. Wire fraud against Theranos investors: wire transfer of $5,999,997 from Mosley Family Holdings LLC: Guilty

9. Wire fraud against Theranos paying patients: wire transmission of patient E.T.’s blood-test results: Not guilty

10. Wire fraud against Theranos paying patients: wire transmission of patient M.E.’s blood-test results: Not guilty

11. Wire fraud against Theranos paying patients: wire transfer of $1,126,661 used to purchase advertisements for Theranos Wellness Centers: Not guilty

Wire fraud is kind of a bullshit charge when you think about it. All money for all investments is wired.

I watched the documentary on television and my take was that Elizabeth Holmes was totally weird. I wouldn’t have invested in her simply on that premise alone. Forget about the idea and technology.

Early-stage investing is very difficult. I started doing it actively in 2003, and I have a really good track record. More wins than losses. My exits kept me afloat. I didn’t make income from 2009-2016. I lived off savings, invested more, and got some exits.

It is incumbent on investors to do their own diligence. I remember when I first got in the game and heard the word. I didn’t know what it was. Dennis Serio and Bob Geras talked to me about diligence.

When investments fail, I always look at the diligence I did prior to writing the check. Was it on me? What did I miss? Of course, sometimes, they just don’t work out.

One thing I am really good at is sizing up people. When you invest at early stages, it’s not about the idea. It’s about the people running the business. I have invested in some really really great people.

Elizabeth Holmes from what I could gather from watching her on television and reading interviews with her wasn’t a person that could run a business. People like that don’t put other people around them that can run a business either. They don’t trust themselves or have enough confidence in themselves to put good people around them.

She created a lot of hype and credibility. But, was it the right credibility for what she was trying to do? Henry Kissinger and George Schultz hardly had any street cred for healthcare. If it was an international strategy company, maybe. All that signaled to me was that her parents knew powerful people.

She created a lot of deception. Her stories of forced sex are her playing the victim card. It’s not relevant. She sold a bill of goods to investors that she knew was false. At the same time, the investors weren’t smart enough to sniff it out. Shame on them. That’s where the onus and responsibility are.

As an investor, you hear lots and lots of pitches. Some entrepreneurs “fake it till you make it”. Some just have bad ideas. Some are trying to raise money so they aren’t forced to go get a “real job”. It’s up to you to tease out the particulars before you write the check.

Crap, I remember taking an afternoon on Ocean Blvd in Los Angeles to hear a bunch of pitches revolving around cryptocurrency companies. Not one of the pitches made any sense whatsoever. There was so much bullshit flowing I thought I was in a cattle barn. No one there was guilty of fraud, and if they would have accepted money from investors, they weren’t guilty of fraud either.

Of course, there is a level of trust that has to happen between investors and entrepreneurs. When they give you numbers, you don’t do a full-scale audit. You just have to trust them that they are telling the truth. I have been involved in a couple of deals where numbers were fudged and we found out after. It spoils the relationship.

It’s important to remember that as an investor, you are building a trusting business relationship with the CEO. You consistently work to reinforce that trust. As an investor, you shouldn’t make claims that you can’t follow through on either. That happens a lot too, just ask entrepreneurs.

I remember doing diligence on a company I am still invested in. It’s called NuCurrent. The CEO is Jacob Babcock. Jacob found the technology at Northwestern University. Originally, it was supposed to be used for paralyzed people, but the tech didn’t work. However, they found that they could use it for wireless power. They are based in Chicago and they have a thriving business.

Jacob doesn’t appear to be a classically perfect person to run a tech company like NuCurrent. Neither was Elizabeth Holmes. After all, she was a 19-year-old Stanford student. Turns out, she got into Stanford because of her parents, not because she was a child wunderkind. It’s not that 19-year-old kids can’t startup great companies. They can. But, she was in the medical field and that’s not something a 19-year-old can start.

As I said, Jacob didn’t appear on the surface to be that classic entrepreneur type either. Jacob is smart, but he’s an attorney. It turns out, having the training of law school made him the perfect person to run NuCurrent. We couldn’t have made a better pick. Jacob is also honest, whereas Holmes was not.

The people working with Jacob were tops in their field. They were highly trained Ph.D. electrical engineers who had resumes and recommendations that said they could at least attempt what they were attempting to do and have a high probability of success. It’s generally a good sign when people like that can be recruited to build a company by the CEO.

In individual interviews with those people, the answers were all similar. So, you knew that the story was tight. You knew the mission was buttoned up. There were no hesitations. Plus, people smarter than me in the Hyde Park Angels group who had some experience in this industry also piped up and said everything was credible.

Network can be invaluable when investing at early stages.

There was another competitor to NuCurrent back then. It was funded by a reputable VC. The name of the company was called UBeam. I was very cognizant of UBeam because the VC that was behind them had a big soapbox. He had a lot of credibility in the community and it would seem that they could raise endless rounds of capital while they figured it out.

In our diligence, we found out that UBeam’s tech didn’t work. None of their claims were true. They eventually lost all their staff. An engineer blew the whistle that they were a fake. Their claims were just as fraudulent as Theranos. The company still exists today. Companies can survive bad events if they have the right backing and someone on the team that can move the ball forward.

There certainly was some dissonance inside me prior to making the investment. I mean, credible people had invested in the competitor. Jacob helped us through that dissonance. That is the job of a CEO during diligence.

I will note as an aside, Jacob’s politics and my politics are diametrically opposed for the most part. Unlike a lot of people on the left and a lot of VCs that have lefty tendencies, I don’t give two whits about politics and investing. My only concern is that the entrepreneur has the fire in the belly to build a billion-dollar company. They get an island. I get a Porsche that fits.

At the end of the day, the only question that needs to be answered is can you build a business and earn investors a return? If I don’t think you can, no investment.

Believe me, when I tell you, VCs discriminate like crazy if politics don’t align. I won’t name names here, but some of the most famous ones you know are highly discriminatory. They would never invest in an out of the closet Republican. Never. It’s gotten worse since Trump was elected, and even worse now that Slo-Mo Joe is in office.

Anyway, NuCurrent has had the typical twists and turns of any startup company. Jacob is still at the helm and they have become the number one wireless power company in the world. They hold hundreds of patents. No matter which wireless power standard you use, their technology is the best. At the outset, intellectual property was a strategy. Yet another reason Jason’s legal training proved to be valuable for this company.

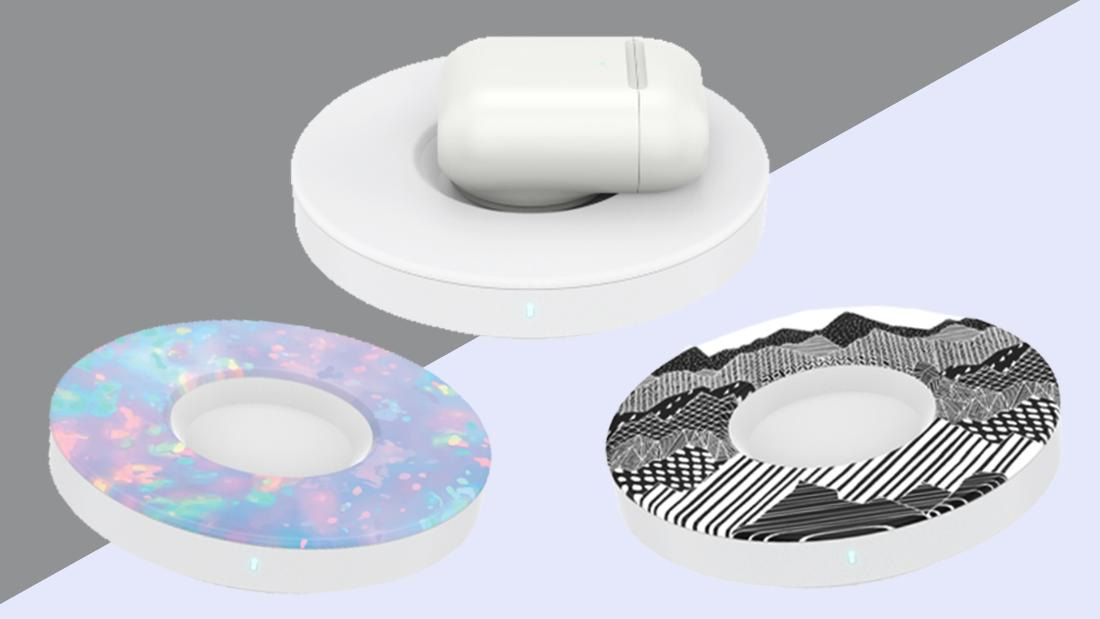

A few years ago, they partnered with PopSockets to create the best phone charger on the market. It was considered one of the best and most innovative products at that years’ Consumer Product Show. I put them in our cabin in Minnesota, and in our house in Las Vegas.

When I saw the Theranos verdict I wasn’t shocked given the media hype. However, I don’t think “investors were defrauded”. When you invest in startups, you do your diligence. It’s buyer beware. The only reason to find someone guilty of something is if end user consumers were harmed in some way.

You can’t hurt the public with what you are doing. If you do, there is some liability.

It’s sad for the employees of Theranos. They invested their human capital into a business idea. They had stock options that are now worthless. They might have accepted less of a salary to work for Theranos because they believed in the mission. Of course, it’s incumbent on employees to do their diligence on companies they go to work for too.

Theranos sold into distribution. Where was the diligence on the part of the distributors? Why aren’t they being sued?

I don’t think this is the end of the line for criminal or civil cases when it comes to Theranos. It’s just a whistle-stop on the tour.

I should add, the reason Holmes was so "revered" wasn't only the connections of her parents. It was because she was female and as we all know the "female market" is underserved. Of course, that's total bullshit. I don't know one investor that has turned down a company because of someone's gender or race. Not one. People that use that excuse are full of shit, or victimhood and they shouldn't be running a company anyway.

Your insight is utterly amazing. Thanks for sharing. The verdict surprised me a bit today, I expected her to be let off given the venue.