I have been sifting through all the information on Silicon Valley Bank. I am trying to tease out objective information and not the other noise. I watched two webinars with Foley and Lardner law firm and Cooley Law. They attacked the problem from different perspectives but some conclusions can be drawn from both.

I feel a lot of empathy for anyone that banked there. You didn’t deserve this.

Here are some actionable salient points for both startups and public companies.

Make sure your D+O insurance is paid. If you miss payroll, people can be held personally liable.

Figure out a way to make payroll and make sure you pay the IRS. This could be in the form of actual checks, not wires or some other method. Creating credit card debt is not out of the realm of possibility.

If you are a public company, consult with your counsel on the best way to present your exposure to SVB in your 10-K, or by releasing public statements.

If you are a startup and have exposure, make sure your investors know. If you are a startup and have no exposure, it would be comforting to know that too.

If you run a fund, let your LPs know you did your triage and let them know if the fund is exposed or not. We did this with our companies and LPs.

Insured bank deposits will be available Monday up to $250K. If you had a smart sweep account, or a customer repo account, the money will be available and you didn’t lose any. If you had money with an RIA, the money is probably held at US Bank so you should be okay.

You should rethink all your banking relationships and examine them. Ask the bankers hard questions. Are they too concentrated in one industry or is their customer base diverse? Do they hedge their portfolio no matter if it’s held to expiration or marketable? How do they hedge, private OTC transactions with third parties or in a regulated futures market?

This is a hard problem since many companies have millions or billions in deposits with banks. $250K insurance seems paltry. But, I am not sure we should increase the size of deposit insurance since that has costs and might create a lot of adversity for smaller customers.

Now to the mess.

SVB had created a niche for itself in businesses that were traditionally shunned by big banks. These businesses had uneven banking, and their needs were unique compared to a typical business. Startups, PE funds, VC funds, and Hedge funds were banked there.

One theory that I have heard that cannot be discounted is the role of the SEC. Gary Gensler is trying to kill the crypto industry by creating chokepoints. When Silvergate went belly up, it created a cascading effect. Many crypto companies banked at SVB. SVB going down with Silvergate kills a lot of the on/off ramps between fiat and crypto. Crypto stablecoin company Circle had $3.3 billion in assets with SVB. Their stablecoin is trading at .85 on the dollar. Roku is another public company that had a large account there.

Another thing that I heard, but have no confirmation on, is many life sciences companies banked at SVB. Many wineries banked at SVB. It goes without saying a large percentage of startups banked there. The cash flow crunch in this community will be felt for a bit while things work themselves out.

Cooley made a point of saying typically it takes 8-12 months for it to work itself out. There is a difference between bank equity, and deposits. I have seen reports that when Washington Mutual (WAMU) went tap city in 2008, depositors were made whole by JP Morgan. Will the same thing happen here? I suspect it will but it will take time, and bear in mind I am not a banker or a lawyer.

The signs were there. This is from January 18.

Many VCs are calling for a bailout. I disagree despite the empathy I feel for companies that banked there. I disagreed vehemently with bailouts in 2008. One VC pulled money last year so it’s not Peter Thiel’s fault. There were people that did their research and shorted Silicon Valley Bank’s stock. Everyone talking about a bailout should read and understand this.

Riding on low-interest rates at the beginning of the COVID pandemic, startup funding soared to new heights as startups reeled in billions from venture capitalists and VCs raised enormous multi-billion funds. It was all a win for SVB, as many of those startups would park their newly-won funding at Silicon Valley Bank, then draw from it as needed. Venture funds would borrow from SVB as they waited for limited partner dollars to hit the bank. As Silicon Valley Bank required some of those funds to park money as collateral for those loans, SVB was sitting pretty.

Non-interest-bearing deposits at the bank soared to $126 billion in 2021, nearly double the $67 billion the bank held in 2020.

What to do with all that new cash on the balance sheet?

“In 2022, the liability composition changed so much and so quickly,” Wettlaufer explains as he walks me through his own models.

At the height of the venture boom, with the bank sitting on so much cash, its long-term securities portfolio grew from $17 billion to $98 billion, Wettlaufer explains. SVB invested that cash at the height of the market.

Now, interest rates aren’t zero any more, and that long-term securities portoflio is underwater by about $15 billion, Wettlaufer says, meaning that, if SVB had wanted to trade bonds within that long-term portfolio to free up capital, it might have had to recognize somewhere up to $15 billion in the unrealized losses it had reported at the end of 2022.

The other thing that SVB didn’t do as far as I can discover is hedge any part of their portfolio. As I illustrated yesterday, if they would have hedged, they wouldn’t have lost much money. That’s poor management. Malfescence even. I have thought about asking some buddies from the floor who used to do this for a living to actually take a crude look at their portfolio and put together a model hedge with math. YOSH, STMP, and YAZ were three of the best and put together all sorts of strategies using futures and options to hedge for clients.

Francine McKenna reported that the risk committee of the board met 22 times in 2022. Most bank risk committees meet 5-7 times. Isn’t that a red flag?

Silicon Valley Bank is another case of “get woke go broke”. The entire bank culture was worried about their image to the outside world and catered to the far left wing rather than concentrating on the nuts and bolts of running a bank.

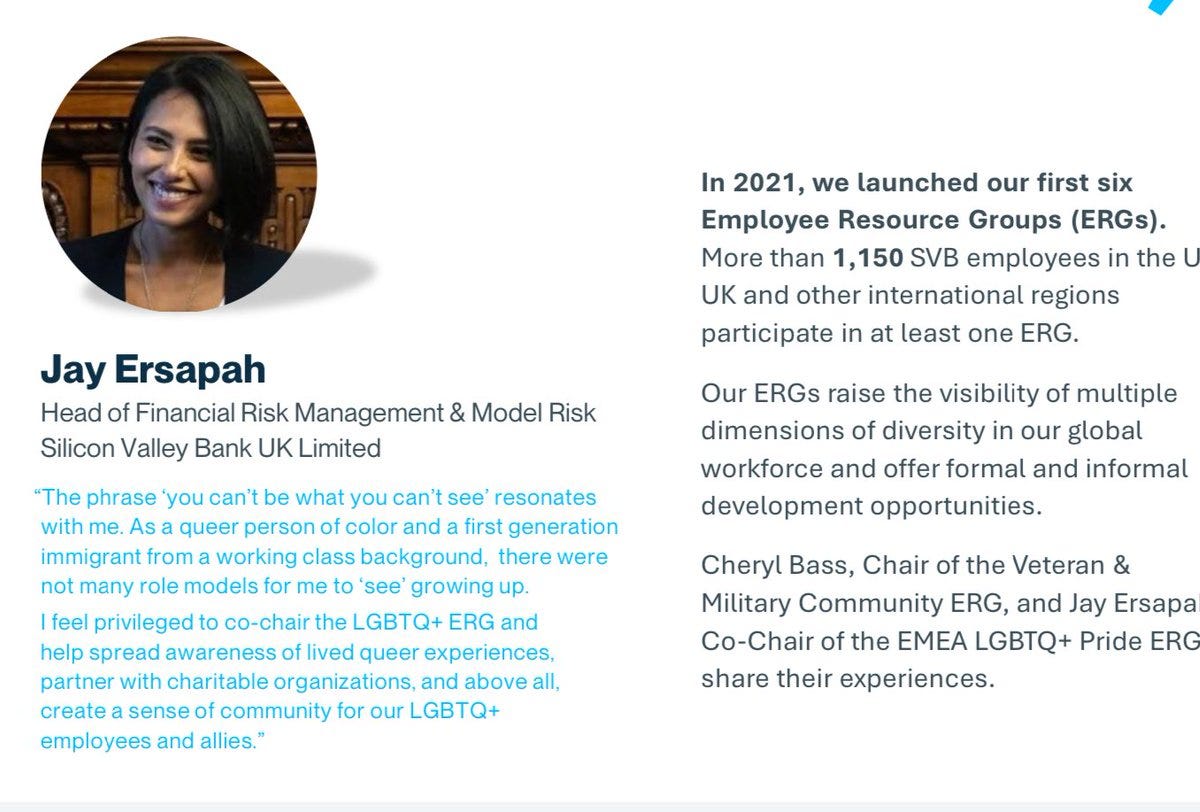

Here is a risk manager’s profile at SVB but candidly, they went without a Chief Risk Officer for 10 months while the Federal Reserve raised rates in an unprecedented manner. Amazing how management didn’t have its eye on the ball. I scrolled through the top leadership on their website and read their bios. There is a lot of virtue signaling about inclusion and giving back. They went to “top schools”. The current risk manager who joined the bank in late 2022 worked in banking but went to Harvard majoring in political science and public policy.

Today now that your money is in limbo, do you care about what she wrote? Do you care that SVB had ERGs? Here is a letter to clients from September 2021 from the CEO. There is a large paragraph about “giving back”.

No one is against helping people and all that but there are costs and opportunity costs. Silicon Valley Bank didn’t understand that, nor did they know how to accurately measure risk.

Love this tweet:

Sure, the Fed raised rates. Other banks didn’t seem to fail because of it. Why? Yes, Joe Biden appointee SEC chair Gary Gensler has a hard-on for killing crypto and he did some big-time damage. Other traditional banks didn’t fail because of Gensler’s mismanagement and vendetta.

Where are the stress tests? Didn’t we go through a whole stress test thing after 2008? One explanation is that SVB was not a federally chartered bank but a state-chartered bank. Someone ought to be asking the California bank regulators and examiners a lot of really uncomfortable questions. That falls on Governor Gavin Newsome’s lap.

Fed Chair Powell has said he will look at the data, and hopefully, he will carefully consider this sort of situation before he raises it again. The Fed started out way behind the curve and left money too cheap for way too long. I have been saying this since at least 2014. Terrible Covid policy and a total overreaction by the political and elite class created a situation that was very difficult for the Fed. Rampant unchecked government spending combined with a forced economic shutdown and 0% interest rates aren’t a recipe for restraint.

Currently, Treasury Secretary Janet Yellen is more concerned with climate change than she is with the health of the US banking industry. She was one of the worst leaders of the Federal Reserve in the history of the organization and her track record as Treasury Secretary is just as poor.

The government blew it on Covid. It was a virus that killed people who were already pretty sick or unhealthy. It turns out, the vaccine might be worse than just getting Covid and getting over it. We are seeing the after-effects of terrible Covid policy and government spending policy all over the economy. Still, that doesn’t excuse the management team for blowing it at SVB.

To be clear, the management team at SVB 1000% blew it. The responsibility, accountability, and blame lie directly at their feet.

The economic environment in the US since Biden has been elected has turned south. Our economy sucks, and when things suck all kinds of areas that used to look robust become vulnerable. No one will admit that we are in recession, but we are and have been in recession. This failure will exacerbate the recession since it affects startups and they are a large part of the job market in the Bay Area.

One thing that might happen is as long as their bank doesn’t exist, companies might just abandon the Bay Area. It’s been going downhill for years. People have been fleeing. This might encourage more flight. Nevada is open for business. Great broadband and cell service, low taxes, cheap office space, a great airport for getting around the country to see customers, and decent weather. You could do worse.

I look forward to the day when we don’t really care about all the touchy-feely virtue-signaling crap and have competent capable people running institutions that can do their jobs. I could give two craps about anything except can you operate a business and take care of your customers. Can you lead? Can you problem-solve? Do you listen? Can you take the mess that I have given you and turn it into an actionable strategy? I want my banker to be my banker, not my shaman.

Nowhere have I seen anyone say that the portfolio at SVB was hedged. Nowhere. No one is even talking about it. If I were the CME Group’s ($CME) marketing department, I’d put SVB on a poster advertising my interest rate futures complex.

Point the finger at SVB management.

Addendum Sun Mar 12 (my comments in italics):

Here is the latest intelligence on Circle. Circle is a stablecoin provider ($USDC) for crypto. Essentially, you put one fiat US dollar in, you get one $USDC stablecoin.

Circle stated that its liquidity operations will resume “as normal” when banks open on Monday morning in the US and that USDC will “remain redeemable 1 for 1 with the US dollar.” (anyone that shorted is in trouble!)

According to Circle, “USDC is 100% collateralized with a combination of cash and US Treasuries.” USDC collateralization is reported as:

77% ($32.4B) in US Treasury Bills (three month or shorter maturities)

23% ($9.7B) in cash held at various institutions (including SVB)

(hence, the cash is probably not only in T-Bills, but overnight repos, so it’s all there)

Circle states that its Treasury Bill reserves are held in custody by BNY Mellon and that active liquidity and asset management is managed by BlackRock (the entire liquidity ladder down to the CUSIP number on the T-Bills can be viewed here).

As for the $3.3B of USDC’s cash reserves that were held at SVB, Circle claims that it had initiated transfer of these funds to another banking partner or partners “as of Thursday.” These transfers had not settled as of close of business on Friday. (they might be in limbo for a bit, but the money isn’t lost as long as it was invested in the name of Circle which SVB would have done in an overnight repo situation, or smart sweep checking situation)

Circle’s position is that, under applicable FDIC policy, transfers initiated prior to a bank entering receivership “would have otherwise been processed normally” and that the FDIC “should allow transactions to settle in the ordinary course through the end of a bank’s standard daily processing cycle until the FDIC takes control of the failed institution.”

If SVB does not return 100% of the USDC reserves held by SBV, then Circle states that, “as required by law under stored-value money transmission regulation, [it] will stand behind USDC and cover any shortfall using corporate resources, involving external capital if necessary.”

I am seeing a lot of noise on Twitter today and not a lot of real concrete information. My guess is that someone in the banking industry will want to buy a piece of SVB’s business. I saw Joe Maxwell of FINTOP Capital say that all their banks are ready to help.

First Republic is the next likely candidate to fall only because they competed head to head with SVB and if they followed the same internal management procedures with regard to risk management, they will and should fall.

I do not think there is “contagion” in the banking industry like there was in 2008. This should be relatively contained. However, there will be a lot of pain felt as startups and businesses that banked with SVB (and possibly FRB if they fail) as payrolls become challenging to meet and vendors do not get paid. It’s going to be more of a cash flow crunch than a “contagion” crunch because SVB’s target market while large is not related to typical banking markets.

Everyone wants a cataclysmic event for a variety of reasons and while this isn’t fun it’s not 2008, it’s not Long Term Capital in 1998, and it’s not the internet blow up of 2001, nor is it the crash of 1987. It is a total abject failure of SVB management to grasp basic financial and risk concepts along with a total failure of regulators. More regulation will not solve this problem now or in the future.

In the first week of MBA class at Chicago Booth, we were taught the difference between accounting numbers and economic numbers. It’s a basic concept, but can be hard to grasp—especially with all the noise today.

If you are short the stock market, I’d have an itchy hand on the trigger to get out, but I wouldn’t go long either. Tomorrow might be a good day to trade small or walk the dog. If you want to watch real traders in action, tune into Tastytrade. You won’t learn anything watching CNBC, Fox Business, or Bloomberg. The only person I know that would truly get it is Rick Santelli since he understands how to hedge a treasury portfolio.

Also they had no liquidity management. Who allows a balance sheet structure that lets depositors present $4 billion in a single day? Any competent bank team terms out its liabilities so they don’t all come due at the same time.

Where was the SF FRB? Didn’t they have a team of examiners on-site all the time? Weren’t they looking at liquidity reports and contingency funding plans?

Incredible incompetence here on all sides.

There will be zero appetite to bail out SVB. I don’t recall seeing a bail out for the people of East Palestine OH. VC investing and lending are inherently risky. They assumed that risk and compounded it by poor balance sheet management, most proper run banks would hedge that exposure. The only government support I could see happen is a buyer will likely want a back stop or a guarantee for souring loans from government. Similar thing happened through FDIC arranged mergers in 08, I don’t think it should be provided but without that guarantee I don’t see a buyer. Those discussions are being had in bank board rooms across America this weekend.